Uniflex Cables Limited, a leading cable manufacturer and exporter, started its journey in 1981 as an elastomeric division. The company was established as Uniflex Cables Limited in 1992. In1993, a power cable division was added to it. In 1995, the company had an optical fibre cable division as well. The division for jelly filled cable was started in1996. In 2003, the company expanded its business in the export domain; and in 2008, it became a subsidiary of Apar Industries.

The company has three divisions, namely the XLPE/Elastomeric Cables division, the Fluoro-Polymer and PVC Cable division and the Optical Fibre and Jelly Filled Cable division, and offers a range of quality cables, including LT power cable, PVC power cable, XLPE power cable, XLPE control cable, instrumentation cable, fire resistant cable, fibre optic cable, jelly filled telecommunication cable, telephone cable and flexible cable. The cables manufactured and exported by the company are designed after detailed engineering to meet the specific requirement of the clients.

The company’s state-of-the-art infrastructural facilities assist it in the production of quality cables in bulk and as per the exacting requirements of its clients. These facilities include wire-drawing machines from Niehoff, Germany, for rod breakdown and for multi-wire drawing supported by an in-house copper tinning facility; Royale USA CCV (dry cure) line to manufacture HT XLPE cables, extruders from highly reputed manufacturers for high quality extrusion; stranding, drum twisters and laying up machines, armouring and other manufacturing machineries from most reputed machine manufacturers; in-house manufacturing of almost all compounds to maintain quality; high quality test and measuring equipment and a centralised laboratory; capacity expansion undertaken to almost double the plant capacity; and a conductor manufacturing new facility setup with APAR.

The Wire and Cable India team (WCI) recently interviewed Mr. V. K. Bajaj, Chief Operating Officer, Uniflex Cables Limited, to find out how the year 2013 had been for the company and to have an understanding of the challenges that today’s Indian wire and cable industry faces.

Here are some of the excerpts from this interesting interaction.

WCI: How has the year 2013 been for Apar Industries and Uniflex Cables?

V. K. Bajaj: The year 2013 was a difficult year especially for manufacturers of electrical products. The economy slowed down and, as a result, GDP growth was relatively low. Also, we had to grapple with financial difficulties and problems arising from slow governmental decision-making. Many of the key economic drivers for electrical industry segments, such as power generation and distribution and infrastructure, did not grow as per plan, which adversely affected the fortunes of the Industry. In fact, IEEMA’s statistics show negative growth in some of the industry segments.

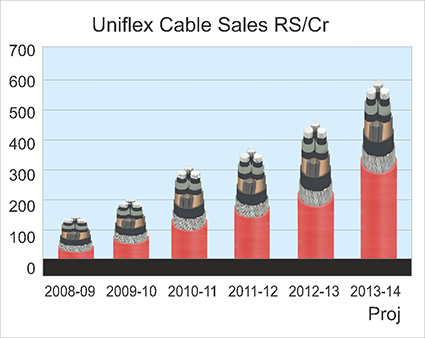

Apar Industries, which is valued at about Rs 5,000 crore, has three broad business areas, namely transformer and specialty oils, overhead conductors and electrical and telecommunication cables. Our transformer and specialty oil segment and cable divisions have shown significant volume growth. However, the conductor division had to bear the brunt of the impact of slowdown despite the fact that it did quite well on the export front. The overall performance of the company in 2013 is quite similar to its performance in the previous year. The Uniflex Cable division has performed consistently better in the last five years, as Apar took over its management in 2008 and the company later merged with Apar. Cable sale has grown at CAGR of about 35 per cent during the last five years. Both its electrical and telecom cables have shown 45 per cent growth during 2013-14, counteracting the effects of economic slowdown.

WCI: The economy is growing rather slowly and the Indian wire and cable industry is currently facing a stagnant demand and oversupply situation. In the middle of all this, what are your future plans?

VKB: As an organisation, Apar has been a leader in its chosen business segments. The philosophy it follows can be summed up in three words: Tomorrow’s Progress Today. Keeping this philosophy in mind, the management is working towards strategising and achieving the objective of enabling the cable business to occupy a leadership position in the near future. Cable sale has grown rapidly to about Rs 600 crore, and we have set ourselves a target of achieving cable sales worth Rs 1,000 crore in the next two years. In the last five years, we focused a lot on cable exports and 30 per cent of our sales have come from export sales. During 2013-14, we exported cables worth around Rs 250 crore.

Because of the good quality of our products and service, we are in a position to compete with big market leaders. We do not compete on price. In fact, our prices are a little higher. We tell our customers that they will get their money’s worth as far as our products and services are concerned.

WCI: Tell us about the new developments that have taken place at Uniflex?

VKB: In the year 2013, we commissioned our Electron Beam Irradiation facility – 1.5 MeV and 3.0 MeV – at Khatalwad near Umbergaon to offer specialty cross-linked cables to the transport, shipping, mining, nuclear power and renewable energy sectors. New products for the power and infrastructure segment are being developed – products that can change the future of technology for wire and cables. It has already started putting pressure on competition to follow in our footprint. This facility is expected to improve our brand positioning and business sales volume significantly in the near future.

WCI: How does Apar deliver better, faster and more competitive products and services in today’s fast-changing and uncertain world?

VKB: We are rapidly growing in the area of electrical and telecommunication cables, improving our market share and our brand positioning. To achieve this objective and to cope with the present economic slowdown situation, we have developed specialty cables suited for specific applications both for domestic and overseas customers. Our technical strength and our R&D efforts have enabled us to develop several import substitute products. Our specialty products include anti power pilferage cable, high temperature cables, CRD reeling cables, medium voltage elastomer cables, windmill and solar cables, tactical cables, fire-resistant electrical and fibre optic cables and so on. We have efficient technical design and R&D teams. Our quality assurance team efficiently supports new product developments. The team uses state-of-the-art manufacturing and testing equipment.

To meet our growing sales volume and to continue meeting the delivery requirement of our customers, our works have been regularly enhancing our manufacturing and quality infrastructure. We expanded our facility for power cables, for elastomer cables and for fibre optic cables to meet the growing demand for our products.

WCI: Share your views on the challenges that the industry will be facing in the coming two to three years. What steps should be taken to meet them?

VKB: The industry has been facing a very difficult situation since the global economy meltdown in 2008 and has not really recovered since then. The situation of supply significantly outstripping the demand has arisen from the huge industry capacity that most of the manufacturers have created based on the government’s plan projections about growth of demand, which has not happened as expected. So there is stiff competition and undercutting of prices as manufacturers try to keep their market share intact if not growing. Most of the government projects have been progressing slowly, and payment from utilities to EPC contractors has been affected. It is therefore a double-edged issue of low margin and poor/uncertain payment situation faced by the industry leading to low profitability; and in several cases, manufacturers are making a loss.

This difficult situation has forced cable manufacturers to look for innovative cable designs, alternate sources of raw materials and productivity improvement measures to reduce costs and become more competitive. It has helped cable manufacturers to start exploring export opportunities.

The economy is showing some signs of recovery, and the prevailing situation is likely to start improving from 2014. I think, the Indian cable industry may witness revival and good times in next two to three years.