Issam Siddique*

The cable industry in the Middle East is set for interesting times. The thrust provided by Government backed infrastructure spending has set into motion a direct push for power cables and allied raw materials. The new found infusion mainly from local demand is causing cable manufacturers, especially power cable manufacturers to go full throttle on their plant capacity.

Market Overview

The Middle East region is eclipsed by Saudi Arabian (KSA) market owing to the sheer size and volumes that come into play. It is indeed the KSA market that accounts for the lion’s share of the whole Middle East pie – with the region accounting for the bulk of the demand and consumption in the region.

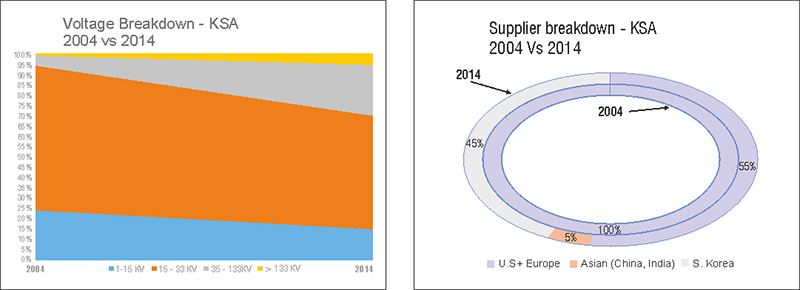

The entire Middle East market is still heavily inclined towards medium voltage (MV) production with very limited high voltage (HV) players. Though the new demands for power transmission is driving the existing players to climb up the value chain and focus on HV and extra high voltage (EHV) range. This push can be substantiated in terms of new plant openings and capacity additions that the region is witnessing. The unavailability of local suppliers for larger power transmission needs has seen veteran players from APAC and Europe import finished cables for higher voltage grades. Increasingly the local players are rising up to the occasion and gaining credibility from utility providers and local contractors for delivery of HV and EHV cables. As per Saudi Electricity Company, the power demand is expected to grow from 55GW to 90GW.

It will not be an exaggeration to say that the region has still further scope for capacity addition if the cable manufacturers can rise up and earn the credibility to supply for the larger power projects that are shaping up in the region.

As far as the sourcing needs of cable manufacturers are concerned, it is the insulation segment that has seen the major shift in dynamics. Over the last ten years, suppliers from Asia – mainly South Korea have managed to eat a substantial chunk of the market. Especially in Saudi Arabia, the dwindling share of European and US manufacturers stand testimony to the change in wind direction with regard to cross linked Polyethylene materials.

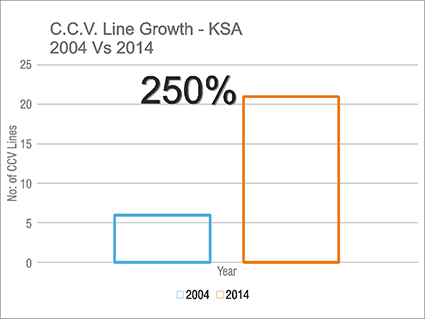

CCV Line Growth

The numbers tell all the story in terms of the Middle East growth. The last decade has seen Saudi Arabian players add close to sixteen CCV lines – both as a result of capacity addition by existing players and also new entrants. In particular the year 2014 has seen massive capacity addition throwing up window of opportunities to raw material suppliers. Players are flexible and open to new entrants and are willing to invest time and resources to test the materials in order to widen the sourcing options.

The Gulf region outside of Saudi Arabia – UAE, Qatar, Oman and Kuwait have also been witnessing growth though not to the same degree as KSA. The growth in this region is largely governed by joint ventures. Large testing and research facilities are aiding the credibility of the Gulf players who are keen to cater to the entire GCC Market.

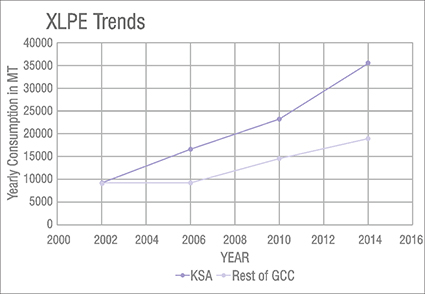

XLPE Trends

In terms of consumption, the pattern of consumption of Saudi Arabia as well as the other Gulf countries reflect the growth momentum the region is undergoing. The graph below shows the growth in XLPE material consumption over the last decade. The curve will only be lifting up even more rapidly in the next few years beginning 2014. Of particular relevance is the steeper growth curve of Saudi Arabia in the last four years. If current market outlook is anything to go by, this climb will only get steeper with the demand put forth by utility companies.

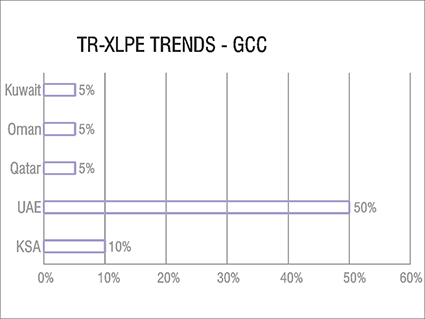

Another interesting trend that is playing out is the acceptance of tree retardant (TR) insulation material. Though the claim has been that TR material usage greatly reduces occurrence of water treeing, it is yet to see wholesome acceptance by utility companies. A point to note is the pull factor that is coming in from certain regions – for example in the Emirates where end users insist on using tree retardant materials even at the expense of rising cost.

Apart from Emirates, other regions are yet to take off in terms of using tree retardant materials. A factor that is influencing the push in Saudi Arabia is the ground water levels of certain regions. In certain areas the ground water levels are almost touching the ground surface and this automatically makes the underground power cables act as submerged cables, thus justifying the need to go for specific materials like TR XLPE. It will be interesting to see how this trend opens up.

In House Compounding

With large volume growth, like the big players in Europe, Middle East cable manufacturers are also exploring the self-compounding path. The availability of feedstock is making this option appealing to the manufacturers. Some have even started their own insulation and semiconductive manufacturing. However, in terms of using insulation for higher voltage grade – upwards of 15 kV, the key challenge has been in maintaining the purity levels of the raw materials-mainly LDPE. This and cost advantage that may come from self-compounding are the major decision drivers for the manufacturers.

GCC Manufacturing

What is perhaps making this trend less attractive is the setting up of manufacturing facilities by global players in the region. Hanwha Chemicals from Korea, one of the key players in supplying insulation materials have commissioned their new plant in Jubail, Saudi Arabia which will produce XLPE as well as semiconductive material. This plant can cater to all the manufacturers based in Saudi Arabia as well as in the Middle East. Further the upcoming plans of other major compounding companies to open up plants in the gulf region will mean large scale availability of raw materials.

The proximity of these plants will ensure that there is less stress on planning to manage the inventory levels of the plants. Earlier, the lead time of getting the materials from Asia/Europe/America by freight put a great deal of pressure on planning to ensure there was sufficient quantity of raw materials in store all the time. In addition to the time advantage, there will be cost saving by means of duty and tax exemptions apart from freight charges. The delivery of raw materials directly to the warehouse will be a factor which will tease the manufacturers and at least temporarily force them to go slow on their compounding plans.

On the whole, the Middle East cable manufacturers can brace themselves for sweeping changes in the years to come. Equally for the raw material suppliers, it is going to be spring time. What is to be seen is how the different players position themselves to leverage the occasion.

* Issam Siddique, Sales & Marketing,

STARPOWER is responsible for

the Wire & Cable division of

the company based in Jeddah,

Saudi Arabia.