Two of India’s largest steelmakers, Steel Authority of India Ltd (SAIL) and Tata Steel Ltd, are moving ahead with capacity expansion although demand is weak and pricing remains subdued. SAIL has started to conceptualize its new mega steel expansion for the next decade, even as its ongoing expansion remains incomplete, while Tata Steel is pushing ahead with its earlier stated expansion and even eyeing the next new venture.

“There is already an in principal approval for the new expansion plan,” SAIL’s chairman C.S. Verma said, referring to a $26 billion expansion plan to take crude steel capacity to 50 million tons (MT) by 2020-25 from about 14 MT now. “A board-level sub-committee is working on the plan.” The proposal could be placed before the board during the next fiscal year, an executive said, not wishing to be named. Verma added that a 50:50 debt-to-equity funding is envisaged for the project that will be set up in SAIL’s five existing plant sites.

“Our ambition is to keep adding, on an average, a million ton per year in India as that is the pace at which we have to grow even if we have to retain our market share let alone increase it,” said T.V. Narendran, managing director, India and South East Asia at Tata Steel. “When we started this decade we were at 7 MT and at the end of this decade we would be in excess of 16 MT in India.”

While the two largest steelmakers are justifying expansion plans, citing likely turnaround in demand, analysts remain pessimistic about capacity utilization levels based on the slow economic recovery and overcapacity owing to the expansion.

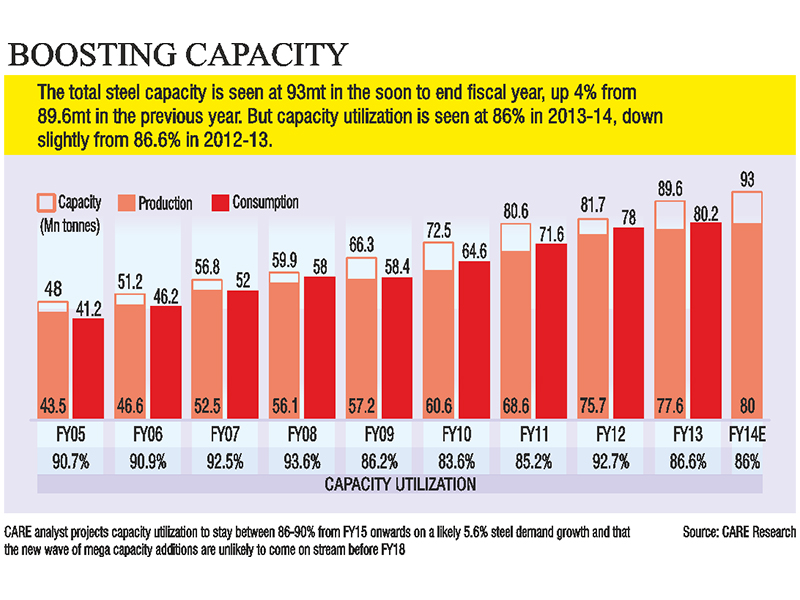

The total steel capacity is seen at 93 MT in the soon to end fiscal year, up 4% from 89.6 MT in the previous year, estimates from Credit Analysis and Research Ltd (CARE) show. But capacity utilization is seen at 86 per cent in 2013-14, down slightly from 86.6 per cent in 2012-13, the CARE data shows.

“The numbers are being pushed, but there is a massive slowdown,” said Hitesh Avachat, group head, metals and mining, at CARE. While state-run SAIL has to tow the government line of projecting higher steel capacities to speak for the nation’s economic growth, Tata Steel and others have no option but to complete the expansion they had embarked upon around 2005-06, as large parts of the project funds have been spent already, and interest costs and depreciation may hurt if these projects are not completed, according to Avachat.

While SAIL and Tata Steel have taken the plunge into the next wave of steel expansion, it may be harder to earn the requisite returns from the added capacity when it comes on stream. “The biggest challenge is that steel sector seems to be in huge oversupply which might last for next few years,” said Rakesh Arora, managing director and head of research at Macquarie Capital Securities (India) Pvt. Ltd.

“This has led to very muted steel conversion margins and makes no economical sense to make substantial investments in new capacity. The lure of profiting from cheap captive iron ore resource is also waning a bit with falling iron ore prices,” Arora added with reference to SAIL’s 2020-25 expansion plan.

The other industry wide problem is the high debt across most private sector steel firms. Tata Steel’s net debt for the six months ended September stood at Rs. 52,442.78 crore on a consolidated basis with a debt-to-equity ratio at 1.53, Bloomberg data shows.

JSW Steel’s net debt for the six months ended September 2013 stood at Rs. 27,010.42 crore on a consolidated basis with the debt-to-equity ratio at 1.32. However, SAIL’s net debt for the six months ended 30 September was the lowest at Rs. 19,039.08 crore on a standalone basis, with a debt-to-equity ratio at 0.54, which may explain its comfort with the ambitious $26-billion expansion.

“In India we will struggle to build capacity to keep pace with demand unless we make it easier for the industry to build steel plants and get the raw material linkages and the land that is so essential to financially justify large greenfield projects,” Narendran said.

SAIL’s new wave of expansion and Tata Steel’s likely future new expansion, as well as plans of the other steelmakers, are unlikely to come on stream before 2017-18, owing to the surfeit of problems that are likely to delay projects, according to CARE’s Avachat.

“Till FY18, capacity utilizations are seen between 86-90% as steel demand growth is seen improving to 5.6% in the years ahead,” Avachat said. In the meantime optimism in the industry stays high.

The government’s projections (300 MT in the next decade from 90 MT now) are based on the view that there would be rapid growth in the per capita consumption of steel in the country, in view of the rapid infrastructure development envisaged over the next decade,” said Ravi Uppal, managing director and chief executive officer of Jindal Steel and Power Ltd (JSPL). He added that an upswing in steel exports from India could also help absorb the additional capacity being added in the sector. n

Source: Media Reports