Curious about the future trajectory of the wire and cable industry? CRU’s comprehensive analysis and industry-leading insights from Mr. Vishnu Patidar, Senior Analyst in CRU’s Wire and Cable team, analyses key trends and developments in both the metallic wire and cable, and the optical fibre and cable industries.

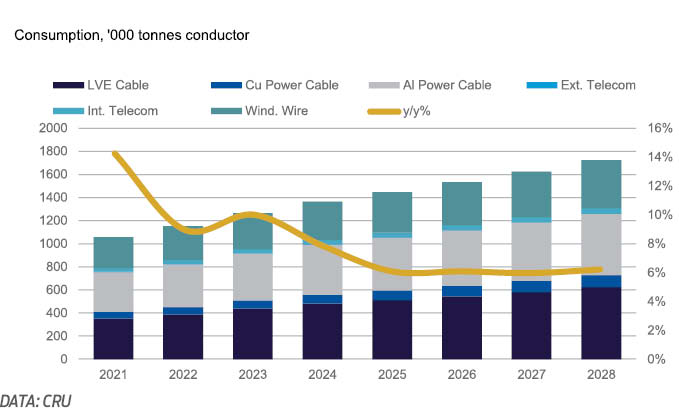

India, the third largest cable market globally, consumed a total of 1,266 kt of insulated metallic wire and cable in 2023, comprising almost 6% of world consumption, only behind China (42%) and the US (9%). India’s insulated metallic wire and cable demand is expected to grow 7.8% y/y in 2024 and is expected to exhibit healthy growth of 6.4% CAGR between 2023–2028.

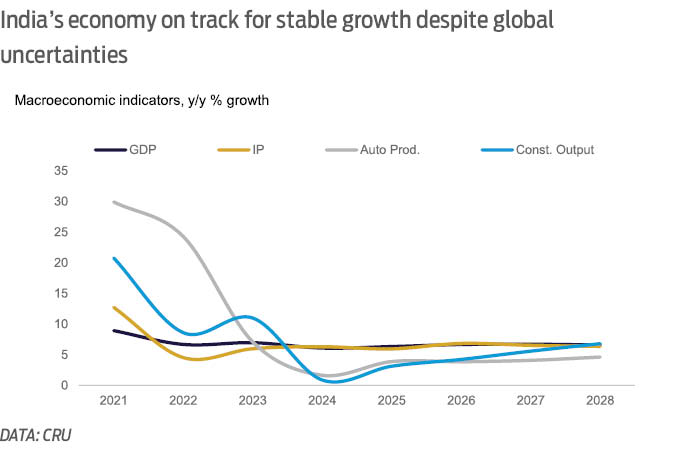

Despite a global economic slowdown, India’s economy remains vigorous. Following a 7% GDP growth in 2023, it is expected to maintain a strong 6.1% growth in 2024, slightly tempered by election disruptions. This growth is driven by robust domestic demand and a thriving manufacturing sector.

In 2023, India’s construction output grew 11% y/y, attributed to the government’s persistent focus on infrastructure development coupled with the ongoing housing market boom. This growth is supported by increasing household incomes, a pronounced housing shortage in major urban centres, and robust population expansion. India now is the world’s most populous nation and as such, the construction sector is the primary consumer of cables, comprising 32% of the country’s total cable demand.

Low Voltage Energy (LVE) cables command the largest market share, accounting for 34.7% of total cable demand. Rapid urbanisation has escalated the demand and investment in residential and commercial infrastructure, which primarily requires LVE cables. India’s Finance Ministry has allocated over $9.5 bn to the ‘Pradhan Mantri Awas Yojana (PMAY)’ scheme, reflecting the government’s commitment to infrastructure and housing. This has boosted demand for LVE cables, which is expected to remain strong in 2024. The construction sector is set to maintain growth above 10% y/y, and LVE cable consumption is projected to increase by 9.5% y/y.

The industrial segment is the second largest contributor of India’s wire and cable demand, accounting for 30% of the market. In 2023, India’s industrial production grew 7% y/y, with the manufacturing sector expected to sustain strong momentum in 2024, achieving over 6% y/y growth. This sector predominantly utilises winding wires for various applications such as motors, transformers, switchgears, domestic appliances, and fast-moving electrical goods. Winding wire consumption in India reached 312 kt conductors in 2023 and is forecasted to grow by nearly 6% y/y in 2024.

Modernised Infrastructure Elevates Power Cable Need

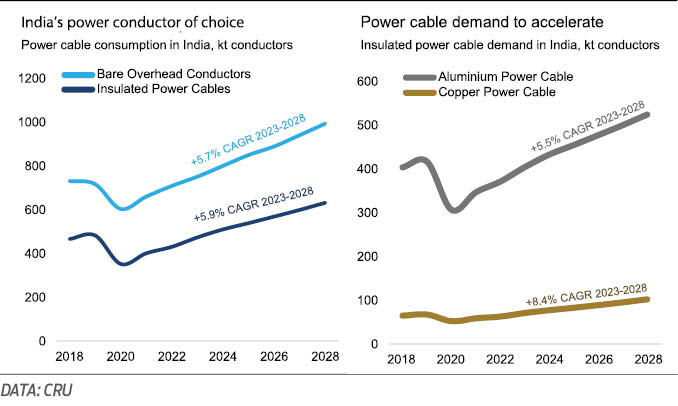

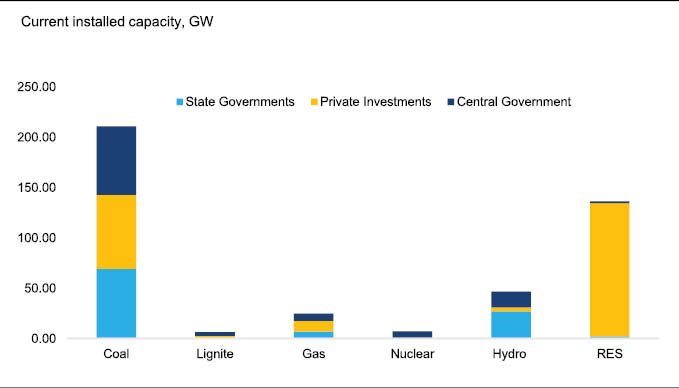

India is the third largest producer and consumer of electricity globally after China and the US. According to CRU’s Power Transmission Service, the nation’s installed power generation capacity of 517 GW in 2023, projected to rise to 781 GW by 2028, necessitating a robust power transmission and distribution infrastructure. However, the per capita annual electricity consumption in India stands at around 1,327 kWh, well below the global average of per capita annual electricity consumption, which is estimated to be around 3,700 kWh.

India’s manufacturing and services sectors which are the two largest consumers of electricity. Despite being the world’s most populous country, the residential sector is the third largest consumer of electricity, with most of the consumption largely concentrated in major urban centres, Tier 2 and 3 cities as well as surrounding areas, with rural areas lag due to infrastructure limitations.

In order to deal with this issue, the country is making strides in strengthening its transmission and distribution infrastructure to cater to this need. Under the ambitious PM Gati Shakti National Master Plan, India’s National Grid capacity is set to experience substantial growth, with an anticipated addition of about 28,700 circuit km capacity by the fiscal year 2024-2025.

The power utility sector in India accounts for nearly 30% of the total consumption of wires and cables in the country. In the year 2023, the consumption of copper power cables in India was recorded at 70.8kt conductors, while aluminium power cables accounted for 404.5kt conductors. The Indian market, characterised by its price sensitivity, has traditionally favoured aluminium power cables due to their cost-effectiveness when compared to copper power cables.

The transition towards modernising India’s electricity transmission and distribution infrastructure is being propelled by government-led initiatives like the Revamped Distribution Sector Scheme (RDSS), which is launched to aid DISCOMs in enhancing their operational efficiencies and financial sustainability, by providing result-linked financial assistance to bolster their supply infrastructure, contingent upon meeting pre-qualifying criteria and achieving basic minimum benchmarks. This scheme represents a significant investment of $35.8 billion, inclusive of budgetary support nearing $12 billion.

In addition to the RDSS, other significant initiatives such as the Integrated Power Development Scheme (IPDS) and the National Smart Grid Mission (NSGM) are playing a pivotal role in the overhaul and modernisation of India’s electricity transmission and distribution infrastructure, by harnessing advanced technologies and intelligent grid solutions, aim to bolster grid reliability, optimise energy utilisation, and integrate renewable energy sources. This progress is, in turn, fuelling the demand for power cables within the country.

Watch: RR Kabel | Solar Cables | Solar Plant | Renewable Energy

Green Energy Pledges Fuel Action And Investments

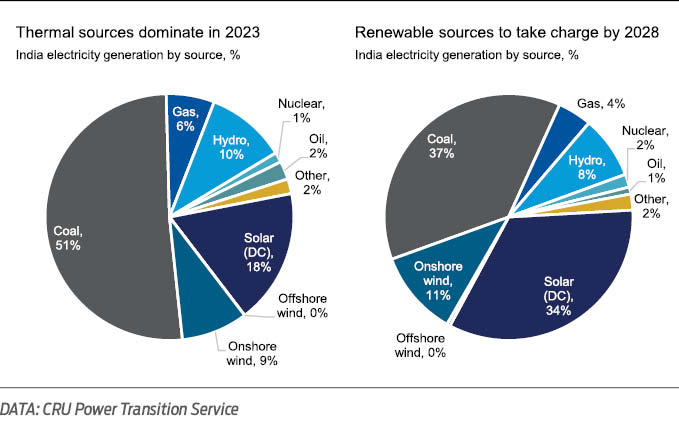

India, being the world’s third largest contributor to greenhouse gas emissions, accounts for 7% of the global total on an annual basis. Despite its substantial dependence on coal, the nation has pledged to attain “net-zero” emissions by 2070. This commitment is accompanied by ambitious objectives to augment renewable energy capacity, fulfil half of its energy requirements from renewable sources, and curtail greenhouse gas emissions by one billion tonnes by 2030.

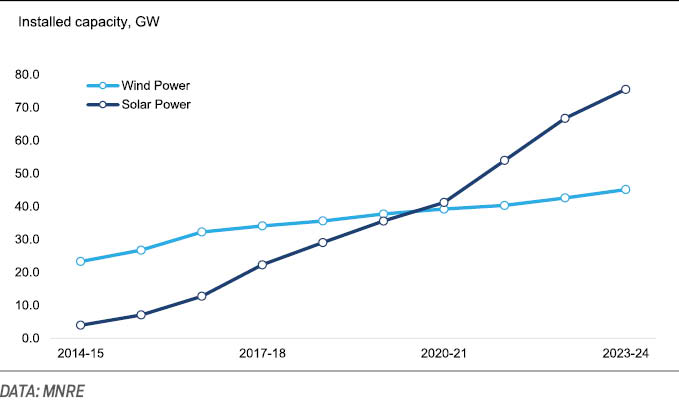

Central to India’s renewable energy ambitions is the objective of producing 500 GW of energy from renewable sources by 2030, an endeavour projected to necessitate investments exceeding $30 billion. This initiative signifies a transformative shift in the country’s energy paradigm, with solar energy poised to play a pivotal role. By capitalising on the plentiful solar resources, India aims to diversify its energy portfolio and diminish its dependence on traditional energy sources.

India’s renewable energy goal of 500 GW by 2030 comprises 280 GW from solar and 140 GW from wind power. With an earmarked fund of nearly $1.8 billion for key capital investments to reach net-zero emissions and secure energy, India is poised to exploit renewable energy potential, thus boosting demand for essential components such as wires and cables.

The government’s plan to install 140 GW of wind energy by 2030 requires substantial sector investment, increasing demand for specialised cables. India’s current wind energy capacity is 45.8 GW, all from onshore projects. The aim is to add over 30 GW from offshore projects by 2030, with the “First Offshore Wind Project of India (FOWPI)” being the only one in the pipeline, at 200 MW. To stimulate offshore wind power development, the recent interim budget announced viability gap funding for an initial 1 GW capacity, and a bidding process for a 4 GW offshore project off Tamil Nadu’s coast has been initiated.

Solar energy’s dominance in India’s renewable sector is driving demand for solar E-Beam cables. These cables, made with electron beam cross-linking technology, feature metal wire conductors, rodent resistance, and UV-stabilised PVC sheathing. They provide superior insulation, vital for high-temperature short circuits.

India’s renewable energy capacity stands at 143.6 GW, reaching nearly 190 GW with large hydropower plants. To meet the 500 GW target, an additional 310 GW is needed within six years. To address this, the Ministry of New and Renewable (MNRE) in April 2023 announced plans to bid for 50 GW annually until 2028.

In a parallel effort, the Indian government is encouraging rooftop solar adoption to meet renewable targets. The “PM Surya Ghar Muft Bijli Yojana” scheme, with a $9 billion investment, aims to equip 10 million homes with subsidised rooftop solar panels. Households can sell excess electricity back to the grid, receiving 300 KWh of free power monthly. India’s current grid-connected solar rooftop capacity is 11.8 GW, with a goal of 40 GW by 2026, reinforcing its commitment to sustainability.

EV Ecosystem To Boost Future Wire And Cable Demand

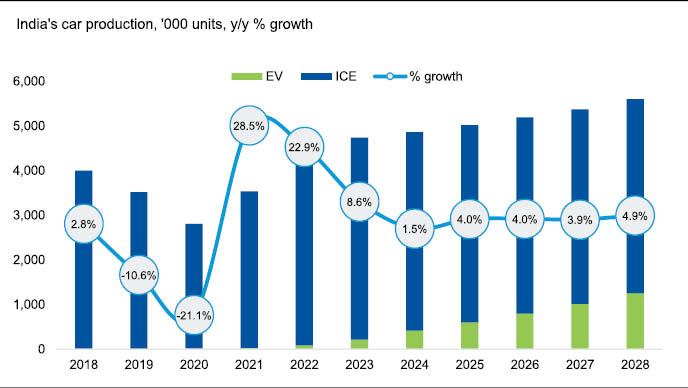

India’s EV push has opened up opportunities across sectors like mobility, energy storage, and charging infrastructure. This includes EV franchising, OEM market, battery infrastructure, solar charging stations, and battery swapping technology. The growth of India’s EV market will significantly impact the wire and cable industry due to the need for specialised cables as EVs necessitate a higher amount of specialised cables and wiring for power transmission, battery management, and other electronic systems compared to conventional Internal Combustion Engines (ICE).

India aims to electrify 30% of its vehicles by 2030. This is supported by policies like the FAME scheme for EV adoption, the PLI scheme for domestic manufacturing, and the Battery Swapping Policy for charging infrastructure. Stricter emission rules and ICE vehicle restrictions also promote this shift.

India’s EV market, currently at 4.5% of LDV sales, is expected to grow by 82% from 2023 to 2028. Two and three-wheeler segments are adopting faster, especially in smaller cities. The FAME-II scheme, with a $1.2 billion budget, aims to support the adoption of 7,000 e-buses, 55,000 e-passenger vehicles, 0.5 million e-three wheelers and 1 million two wheelers nationwide.

India is committed to strengthening the EV ecosystem through manufacturing and charging infrastructure support. It encourages e-bus adoption for public transport. Major EV players include TATA, Mahindra, JBM, MG, KIA, Hyundai, BMW, Ashok Leyland, Volvo and soon Tesla. With rising EV sales, India may need 2.1 million charging stations by 2030.

Also Read: Wire & Cable India Emagazine May-Jun Issue 2024

Rail And Datacentre Growth To Boost Cable Demand

India’s fourth-largest global railway network is modernising under the 2020 National Rail Plan, with the aim to increase freight transport share from 30% to 45% by 2030 through infrastructure and technology investments. Currently, 95% of Indian railways are electrified, with a $778 million budget for further projects, aligning with zero carbon emissions by 2030.

The country is advancing its urban transportation systems, with 60 phases in 28 cities and plans for metro systems in 75 cities by 2027, as outlined in the “Gati Shakti Master Plan,” requiring $35.5 billion.

India’s digital transformation and the rise in data consumption necessitates more datacentres, supported by a $1.7 billion government incentive and $35.9 billion investment over five years. This will significantly increase the demand for telecommunication and power cables.

Unorganised Industry Trumps Major Brands

Major players like Polycab, Havells India, KEI Industries, and Finolex Cables collectively hold 28% of India’s fragmented wire and cable market. Unorganised players still hold over 50% market share. As of 2022, the market is valued at $9.6 billion.