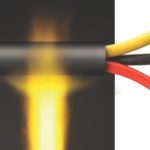

Polymers have played critical roles in every aspect of the ongoing revolution in electrical utilities industry. The largest single outlet for plastics in electrical and electronic applications is in wire and cable, where PVC and Polyolefins dominate on the basis of their formulating flexibility, ease of processing, and low cost. Polymers play a vital role as insulating and jacketing materials which protect the underlying cable core from mechanical, moisture and chemical damage during the installation and service life of the cable. A variety of polymeric materials is being used by the wire and cable industry.

Plastics find extensive use in several areas of fiber optic cables. Buffer tubes, usually extruded from high-performance plastics are being used for sheathing optical fibers. Moreover, because of industry and regulatory concern over combustion, corrosivity, toxicity and environmental impact at the points of manufacture and disposal, the polymers industry is surely feeling the pressure of constantly looking out for better polymeric materials for continued use of polymers in future.

WCI decided to do a special feature on polymers to know more from leading market players. Excerpts:

Wire & Cable India: Please tell us about polymer portfolio you are offering to the wire and cable industry.

Rajiv Arora: Shriram Axiall (formerly Shriram PolyTech) is a world-class organization drawing expertise and resources from a sound infrastructure base that has added a whole new dimension to polymer applications. The company has always sought to anticipate the future and maintain its stride in development and continuous improvement of materials that are engineered to meet the international standards. Presently the offering is based on PVC and various blends and alloys of PVC which offer enhanced properties to customers.

Rajiv Arora: Shriram Axiall (formerly Shriram PolyTech) is a world-class organization drawing expertise and resources from a sound infrastructure base that has added a whole new dimension to polymer applications. The company has always sought to anticipate the future and maintain its stride in development and continuous improvement of materials that are engineered to meet the international standards. Presently the offering is based on PVC and various blends and alloys of PVC which offer enhanced properties to customers.

Shriram Axiall caters to the various segments of the wire and cable industry. For electrical cabling, we offer compounding solutions for power cables, control & instrumentation, three core flat cables, appliance cords, etc. In house wiring, we have compounds for general purpose wire and FR/FRLS wire. For telecommunication, our compounds go into signaling cables, telephone cables, and switchboards. Besides, ShriramAxiall excels in masterbatches.

WCI: Are there any substitution trends among various polymeric materials? Is PVC losing out to Polyolefin in the wire and cable industry?

RA: PVC has a very significant share, almost 65 percent of the total plastics in the elastomeric wire and cable industry. Major consumption is in the power sector, where PVC, on account of its excellent mechanical properties, is the most cost effective solution. While telecom sector predominantly uses Polyethylene cables, the power cables, particularly in the lower voltage sector, continue to be dominated by PVC. Cross-linked PE cables are increasingly being used for medium and high voltage cables; conventional cross linked PE along with Silane cross linked systems comprise almost 12-13 percent of the polymer requirement. New developments in PVC can now offer compounds which can work at 125 Deg Celsius and these are bound to give tough competition to cross-linked PE.

WCI: What are the trends concerning in-house compounding and cross linking, and how will these trends affect the market?

RA: Indian market tends to have more inclination towards make themselves v/s buy from merchant compounders. This is further affected because low capacity utilization in the industry. Further, as long as the market requirement is generic and commoditized, preference is to self-compound v/s buy since there is no technology barrier and capacity is available.

However the situation reverses as soon as the requirement is non generic and some quality requirement is enhanced. In this situation, customers prefer to procure material from quality suppliers with reliability v/s making in-house.

Therefore, as long as the market requirement remains generic and commoditized, self-compounding will continue to hold a dominant position. However, as the market matures and the right quality standards are driven by BIS and the industry, share of merchant compounding will improve.

WCI: How will the balance of PVC/ polyethylene/elastomer demand be affected by cost, environmental and technical considerations?

RA: First, PVC has the lowest environmental foot print v/s Polyolefins and PE. PVC has 58 percent chlorine, so only 42 percent is based on petroleum as compared to almost 100 percent petro-leum content in PE and PO. Elastomer demand is not very high due to high cost and cost performance position. The demand for elastomers in specialized cables is expected to grow, but overall it is not expected to grow much due to other cost effective solutions.

Second, Polyethylene (XLPE) demand has been seeing a good growth rate of 8-10 percent. The environmental footprint for PE is high but its cost position has improved v/s PVC due to imposition of antidumping duty in India on PVC. Demand for XLPE is strong for High Voltage Applications as this is the only suitable polymer for such applications.

Third, PVC has the lowest environmental footprint and it is the most cost effective solution. The demand for PVC is expected to grow at a higher than GDP growth rate once the government spending improves in infrastructure. However, the shortage of PVC resin in India and its high dependence on imports, coupled with imposition and continuation of Anti-Dumping Duty will certainly affect PVC growth in India.

WCI: How are environmental, health and safety, and recycling concerns affecting the overall polymer demand?

RA: Development of synthetic polymers, used to make plastics such as polyethylene, polypropylenes, polyesters and polyamides (including nylon), has revolutionized the types of containers for products, the types of materials for packaging and the materials used for carry bags. However, most of these polymers are not biodegradable and, once used and discarded, become major waste management challenges.

However, plastic waste can also impose negative externalities such as greenhouse gas emissions or ecological damage. It is usually non-biodegradable and therefore can remain as waste in the environment for a very long time; it may pose risks to human health and the environment. In some cases, it can be difficult to reuse and/or recycle. There is a mounting body of evidence which indicates that substantial quantities of plastic waste are now polluting marine and other habitats.

The widespread presence of these materials has resulted in numerous accounts of wildlife becoming entangled in plastic, leading to injury or impaired movement and, in some cases, resulting in death. Concerns have been raised regarding the effects of plastic ingestion as there is some evidence to indicate that toxic chemicals from plastics can accumulate in living organisms and throughout nutrient chains. There is also some public health concerns arising from the use of plastics treated with chemicals.

Over the past 50 years, however, there has been a very steep rise in plastic production, especially in Asia. The European Union (EU) accounts for around 25 percent of world production. The total consumption of plastics in Western Europe was approximately 39.7 million tonnes in 2003, which means about 98 kg/person, and the amount has been increasing. China produces more plastic than any other country, at 15 percent of global production. Germany produces the greatest amount of any EU country, accounting for about 8 percent of global production.

Societies are increasingly reliant on plastics, which are already a ubiquitous part of everyday life. As the development of new materials is ongoing, limiting their detrimental effects poses new challenges for policy makers. Regulatory instruments designed to mitigate the effects of plastics on human health and the environment must evolve in line with trends in production, use and disposal.

WCI: What is the current and future size of polymer market in India roughly expressed in terms of tons of each polymer consumed? Explain as regards to wire and cable industry?

RA: Polymers have found uses in all spheres of life with demand for better materials, greater functional utility, more economical packaging, and versatile and durable all-weather products.

Globally, demand of plastics is estimated at 220 Million tonnes in FY12 with commodity plastics like Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC) accounting for bulk of the demand while engineering plastics like Styrene’s (PS/EPS & SAN/ABS) and others (PA/PBT) accounting for rest of the demand.

Plastics industry is one of the fastest growing industries in India. It has expanded at ~10 percent p.a. over the last six years to reach ~9 MnTPA (million tons per annum) in FY12 from 5 MnTPA in FY06.

A report on the Indian plastics industry stated that the per capita consumption of polymers industry in the country during 2012-13 was low at just 9.7 kg as compared to 109 kg in USA, 45 kg in China and 32 kg in a Brazil. The report points out that about 30,000 processing units with 113,000 processing machines have created manufacturing capacity of 30 million metric tons per annum. This has been achieved with a 13 percent CAGR of processing capacity during last 5 years. The industry has invested USD 5 billion in the machinery and it is expected to make further project investment of USD 10 billion for further increase in capacities during the next 5 years.

As a result, India is expected to be among the top ten packaging consumers in the world by 2016 with demand set to reach USD 24 billion.

Wire & Cable India: Please tell us about polymer portfolio you are offering to the wire and cable industry.

Madan Gupta: We at Kkalpana offer cable compound based on various polymers. In PVC-based compounds, we have insulation and jacket compounds of all types including Low Toxic, FR and FRLS, Heat and Oil Resistant and compounds for sub zero temperature applications. In EVA and POE based, there is halogen-free flame retardant insulation, jacket and bedding compounds. Kkalpana also offers POLYETHYLENE based insulation (natural), Black sheathing and coloured Jacket compounds; LDPE and Peroxide based MV-XLPE insulation compound for CCV lines; LLDPE and LDPE based Sioplas (two component moisture curable) LT and MV-XLPE compounds; EBA and EVA based semiconducting conductor and insulation screen compounds.

Madan Gupta: We at Kkalpana offer cable compound based on various polymers. In PVC-based compounds, we have insulation and jacket compounds of all types including Low Toxic, FR and FRLS, Heat and Oil Resistant and compounds for sub zero temperature applications. In EVA and POE based, there is halogen-free flame retardant insulation, jacket and bedding compounds. Kkalpana also offers POLYETHYLENE based insulation (natural), Black sheathing and coloured Jacket compounds; LDPE and Peroxide based MV-XLPE insulation compound for CCV lines; LLDPE and LDPE based Sioplas (two component moisture curable) LT and MV-XLPE compounds; EBA and EVA based semiconducting conductor and insulation screen compounds.

WCI: Are there any substitution trends among various polymeric materials? Is PVC losing out to Polyolefins in the wire and cable industry?

MG: Not really. Every polymer has got specific application/use in cable Industries. New polymeric compounds are getting use in new applications viz. cables in solar and wind energy. The change where PVC is losing out to Polyethylene is mainly in MV& HV XLPE power cables.

WCI: What are the trends concerning in-house compounding and cross linking, and how will these trends affect the market?

MG: Yes, there is trend concerning in-house compounding particularly PVC and it may happen in case of LT-SIOPLAS in future. It will affect the market for the compounders like Kkalpana.

WCI: How will the balance of PVC / polyethylene/elastomer demand be affected by cost, environmental and technical considerations?

MG: All these raw materials have well established cost benefit equations. PVC occupies the space of most versatile material for compounding at attractive cost point with higher concerns on environmental aspects. Elastomer will find increased usage as the demand for certain technical features comes into play. Polyethylene is delivering highest growth due to its unique capabilities to deliver desired technical features at attractive cost point.

WCI: How are environmental, health and safety and recycling concerns affecting the overall polymer demand?

MG: The demand is governed mostly by the performance features as recycling concerns remain similar to other industries. There are constant efforts for increased recycling of polymer used for cable application as is being done in case of other industries.

WCI: What is the current and future size of polymer market in India roughly expressed in terms of tonnes of each polymer consumed? Explain as regards to wire and cable industry?

MG: PVC and PE are two major polymer used by cable industry. PVC is used for building wire and automobile industry and currently PVC consumption for cable application is estimated to be around 200,000 TPA.

PE is used for power distribution cables, telecommunication cables and OFC industry as well. Estimated consumption is 150,000 TPA currently.

Wire & Cable India: Please tell us about polymer portfolio you are offering to the wire and cable industry.

Sanjeev Bhargava: Bihani Group’s activities are very well tuned for the wire and cable industry. The company operates in three different methodologies. The first is through direct supply of PVC Compounds and Masterbatches from its plant locations in India. The second is through its JV AEI Compounds India Pvt. Ltd. through which thermoplastic HFFR compounds are going to be produced in India and specialized compounds are imported from UK, USA and various different plant location sites. The third methodology is through sourcing of products from other leading global manufacturers and supplying them into India. The consolidated port-folio is expected to touch 50 KTPA by 2016-17.

Sanjeev Bhargava: Bihani Group’s activities are very well tuned for the wire and cable industry. The company operates in three different methodologies. The first is through direct supply of PVC Compounds and Masterbatches from its plant locations in India. The second is through its JV AEI Compounds India Pvt. Ltd. through which thermoplastic HFFR compounds are going to be produced in India and specialized compounds are imported from UK, USA and various different plant location sites. The third methodology is through sourcing of products from other leading global manufacturers and supplying them into India. The consolidated port-folio is expected to touch 50 KTPA by 2016-17.

Our core strengths lie in our ability to understand and articulate on various international specifications and offer products as per that. For example, our Autowire portfolio covers most relevant international specifications including Japanese (JASO D 611, JASO D 618, JISC 3406), European (ISO 6722 T2, T3, T4) and American (SAE 1127, 1128 PVC Type SGT etc and Crosslinked SXL, TXL, GXL). Moreover, we have products designed to meet individual requirements of automakers which are add on to these specifications such as BMW, Mercedes Benz, Fiat, Renault, etc. This therefore makes our portfolio one of the most comprehensive by any compound manufacturer globally.

Similarly, we have products complying to major European specifications such as BS 6746, BS 7211, CENELEC HD21.1, IEC 60502, IEC 60227, EN 50290-2, DIN VDE 0207 etc., and American standards such as UL 1666, UL 1581, UL 758 and NFPA 262 (Under evaluation). This then adds to the already very comprehensive portfolio of AEI Compounds UK., and Saco Polymers Inc., USA.

Bihani stands committed to its customers with an unparalleled range of compounds and is already a strategic supplier to the leading global wire and cable companies. We have recently launched Skinning Compound series for domestic/ building wires designed to improve point-of-sale effectiveness of the cable and wire. Many of our customers have rated our skinning grade ahead of the competition. Similarly, we have TUV approved Solar Cable Compound from AEI UK and LOCA approved Compounds for Nuclear applications. These products are ahead of the game. For any cable and wire company which bases its portfolio on innovation, Bihani is a ‘one-stop’ solution provider.

WCI: Are there any substitution trends among various polymeric materials? Is PVC losing out to Polyolefins in the wire and cable industry?

SB: Change is an essential part of any development process and resistance to change is like swimming against the stream. We have seen increased interest in various compound types within and outside PVC spectrum. Halogen-free has been making way fast and our division AEI India has seen good business in past 2-3 years. We are hoping for the trend to continue until it reaches its crescendo.

Even though PVC contributes significantly to our portfolio and revenues, we have been upgrading constantly and increasing our Capex for R&D and Technologies which will drive us into the future. Having said this, PVC is a very resilient product and the given economics around it will make it a tough challenge for any new technology to be seen as a “replacement”.

WCI: What are the trends concerning in-house compounding and cross linking, and how will these trends affect the market?

SB: We see compounding as a very strategic activity for the companies which have grown to play in larger international markets. In our experience, we ourselves have been associated with leading manufacturers for whom Bihani is now aligned strategically. This, therefore, helps them to focus on their core competencies and free up resources from compounding activities. A strategic supplier of com-pounds allows them to retain control on the activities and costs. Globally, and in all sectors, you would have seen the industry majors freeing up their resources by exiting non-core activities, which gives them further growth thrust whist keeping cost control.

We have designed certain projects through which cable Companies, which have backward integrated to compounding, can unlock their resources and Bihani enters through SPV. Such activities have been very well accepted by some of our customers who have compounding facilities of their own.

WCI: How will the balance of PVC/ polyethylene / elastomer demand be affected by cost, environmental and technical considerations?

SB: To answer this question, one has to look into the target audience of a cable manufacturer and the answer may not be around cost “only”. Also, there is a striking contrast in the nature of demand for standard and specialized products. However, the demand as such of each polymer type as mentioned in the question is generally not swappable. The three aspects of cost, environment and technical considerations are yet to see a convergence and depend totally on the specifications which guide the product.

WCI: How are environmental, health and safety, and recycling concerns affecting the overall polymer demand?

SB: Environmental, HSE, and Recycling need to be addressed separately as they are larger subjects within themselves. Environmental reasons coupled with HSE are being addressed to various international legislations such as the ROHS-2, REACH, GaDSL, etc.

Companies in consumer durables such as electronics, vehicles etc., tend to absorb such legislations quite quickly and these trends follow globally. Through our continuous interaction with companies and societies internationally, we are able to absorb such legislations which are upgraded from time to time. We have been part of some projects which call for evaluation of eco-toxicology and environmental impact of our compounds. This is therefore an opportunity for us as our data and product formulations address to the most recent directives.

Talking about recycling, one may view it differently as the perception plays a very important role. Some automotive companies have allowed certain component of the parts be produced using recycled material. However, there are very stringent control measures to check the effectiveness and long term impact of the product on user and the environment. Using recycled products have their own set of constraints and PVC offers solutions which- if evaluated taking all factors into account- may pose a challenge to recycled products as well.

Wire & Cable India: Please tell us about polymer portfolio you are offering to the wire and cable industry.

Mirisch Damani: For over 3 decades, Zylog has been servicing the automotive, healthcare, appliance, wire and cable, and electrical/electronic industries in India as well as globally with its broad range of Polyolefin compounds, primarily based on polypropylene, EPDM, and Styrene chemistries.

Mirisch Damani: For over 3 decades, Zylog has been servicing the automotive, healthcare, appliance, wire and cable, and electrical/electronic industries in India as well as globally with its broad range of Polyolefin compounds, primarily based on polypropylene, EPDM, and Styrene chemistries.

With innovation at the core of our competence, Zylog’s range of compounds has successfully replaced PVC, natural & synthetic rubbers and several other similar chemistry imported compounds, carving out a niche in the specialty material field with an uncanny reputation for its quality products and service par excellence.

Our extensive polymer portfolio is environment friendly, based on non-halogen resins, recyclable, light stabilized, flame retardant, chemical resistant along with excellent mechanical, thermal and electrical properties.

Zylog offers two specific brands for the wire and cable industry. First one is Neoplast (TPV) which is EPDM/PP based thermoplastic compound, offer properties similar to EPDM rubbers, and used extensively in wire and cable applications in replacement of EPDM and Neoprene rubbers. And, the second is Neoflex (TPE) range of products offer properties similar to NR, SBR etc. Over 20 different grades are commercially offered in the wire and cable industry.

Our compounds find extensive applications in battery cables, automotive ignition cables, automotive fusible link wires, welding cables, trailing cables, submersible pump cables, load cell wires, instrumentation cables, communication cables, control cables, etc.

WCI: Are there any substitution trends among various polymeric materials? Is PVC losing out to Polyolefins in the wire and cable industry?

MD: PVC continues to remain material of choice in India due to its favorable cost benefits, primarily in house wiring and similar other low performance applications. However, as stringent regulatory norms related to safety of high rise residential and commercial buildings gain importance, PVC is getting replaced with Polyolefin based low-smoke, halogen-free, flame retardant wire and cable.

In other sectors, low and medium voltage applications, thermoplastic elastomers, PP, and PE are gaining momentum. In high voltage power and other cables, PVC is getting replaced by XLPE, rubber, etc. materials.

Thermoplastic elastomers are also getting popularity in wire and cable industry due to its unique properties. TPE/TPV are being widely used nowadays in battery cables, automotive ignition cables, fusible link wires, welding cables, trailing cables, submersible pump cables, instrumentation cables, communication cables, control cables, etc.

Though PVC currently remain dominant player, its share may go down due to growing awareness of concern about the environmental effects of toxic emission from waste disposal and recycling of plastics.

WCI: What are the trends concerning in-house compounding and cross linking, and how will these trends affect the market?

MD: Rubber compounding and cross linking is a tedious job and requires lots of technology and infrastructure like banbury, mixing mill, CV line, etc. TPV/TPE provides total solution to cable manufacturer with eliminating the hassles of compounding and cross linking by supplying elastomeric compound in granule forms and processing the same like PVC/PE.

WCI: How are environmental, health and safety and recycling concerns affecting the overall polymer demand?

MD: Environmental, health and safety concerns with the basic raw materials used in manufacturing coated wire and cable are driving innovation and change in the industry. These concerns include life cycle impacts of heavy metals such as lead, brominated flame retardants and resin system based on PVC.

Addressing the various environmental, health and safety issues of coated wire amd cable is not a simple and straight forward process. The complexity of the products and the stringent performance standards make it difficult to find a single ‘greener’ alternative. The cost of such alternatives is the main barrier followed by performance and processability in some applications.

However as new standards and regulations address the life cycle impacts of lead, brominated flame retardants of PVC, the demand for alternatives continue to grow.

WCI: What is the current and future size of polymer market in India roughly expressed in terms of tonnes of each polymer consumed? Explain as regards to wire and cable industry?

MD: Power and telecommunications are main two areas for the wire and cable industry. Power cables mostly use PVC, Rubber, whereas telecommunication cables use polyethylene as insulation material.

Low tension sector (upto 1.1 KV) uses predominantly PVC as insulation and jacketing. The medium tension (1.1 KV to 11 KV) cables use both PE and PVC whereas high tension sector (> 11 KV) uses exclusively polyethylene.

Present PVC consumption in wire and cable industry is estimated to 180 KT. With the government push in infrastructure, housing and agriculture, the market demand is expected to reach to 270KT. Present PE consumption for the wire and cable industry is approx. 55 KT and market is expected to reach 90 KT by 2020.

Following new regulations and environmental concerns of using PVC, heavy metals, brominated flame retardants, demands for alternate materials like TPE/TPV will continue to Grow.

Wire & Cable India: Please tell us about polymer portfolio you are offering to the wire and cable industry.

Ramesh Sankhla: Sankhla polymer offers high quality PVC compounds and PE compound for jacketing and sheathing, low tension XLPE compounds, thermoplastic zero-halogen low smoke compound, specialty masterbatches for termite and rodent repellent, and universal cable masterbatches.

Ramesh Sankhla: Sankhla polymer offers high quality PVC compounds and PE compound for jacketing and sheathing, low tension XLPE compounds, thermoplastic zero-halogen low smoke compound, specialty masterbatches for termite and rodent repellent, and universal cable masterbatches.

WCI: Are there any substitution trends among various polymeric materials? Is PVC losing out to Polyolefins in the wire and cable industry?

RS: PVC is till date the most versatile polymer for house wiring, control cables, jacketing and sheathing of LT and HT cables. PE is slowly gaining volumes in HT cables. LSZH is mostly specified in very limited application. XLPE has substituted PVC for all LT cables.

WCI: What are the trends concerning in-house compounding and cross linking, and how will these trends affect the market?

RS: The major consumers are manufacturing their own PVC compounds. However, XLPE is still out sourced and since most of the product is commoditized, the margins do not permit any more in-house facility.

WCI: How will the balance of PVC/polyethylene/elastomer demand be affected by cost, environmental and technical considerations?

RS: PVC will continue to remain cheapest and most versatile polymer and will have robust demand. The PE compound will grow higher then PVC due to environmental concerns.

WCI: How are environmental, health and safety, and recycling concerns affecting the overall polymer demand?

RS: Except XLPE and XL elastomeric compounds, most of other compound are recyclable and is being done by the industry.

Wire & Cable India: Please tell us about polymer portfolio you are offer-ing to the wire and cable industry.

Manish Singh: For wires and cables, we are offering our range of Thermoplastic Polyurethane compounds.

Manish Singh: For wires and cables, we are offering our range of Thermoplastic Polyurethane compounds.

WCI: Are there any substitution trends among various polymeric materials? Is PVC losing out to Polyo-lefins in the wire and cable industry?

MS: I feel there is lot of transition happening from PVC to ZHFR compounds (Non Halogenated) and even rubber cables are being replaced by materials like TPR, TPV’s and TPU’s.

WCI: What are the trends concerning in-house compounding and cross linking, and how will these trends affect the market?

MS: Compounding industry in India is already very big and entries of new players are making this market more price competitive. However, in crosslinking industry still there is a scope because of high demand from industries like Automotive, Railways, Mining’s and Ship Buildings where people need high heat performance.

WCI: How will the balance of PVC/ polyethylene/elastomer demand be affected by cost, environmental and technical considerations?

MS: Cost is always an important aspect in the Indian wire and cable industry. But, because of safety norms, environmental regulations people start considering technical and environmental aspects while selecting the raw materials.

WCI: How are environmental, health and safety and recycling concerns affecting the overall polymer demand?

MS: It will create demands for technical specialty products rather than commodity products.

WCI: What is the current and future size of polymer market in India roughly expressed in terms of tonnes of each polymer consumed? Explain as regards to wire and cable industry?

MS: India’s polymer consumption in 2014 stood at 2.3 MTPA. However, PVC consumption in the wire and cable industry was at 138 KTPA. ZHFR consumption in the wire and cable industry was noted as 6000 MT (Approx.).