India and China are huge markets. Both countries have one thing in common: They have an increasing need for electricity and therefore also cables.

China

The economic development of the PRC has slowed. Nevertheless, for this year a GDP increase of about 7.5% is expected. In the spring of 2014, China’s National Development and Reform Commission announced 80 infrastructure projects with a total volume of more than EUR 100 billion, which should contribute to reach this target. More than 50 of these projects, which are open to private investors relate to energy supply, 30 of them to the construction of photovoltaic power plants. Irrespective of these projects China has been investing for a long time in the expansion of the power supply. In 2013 China invested nearly 90 billion Euros in this sector, with more than 45 billion Euros in the electricity transmission network [1].

It’s expected that in 2014 the Chinese car market will increase by more than 10% [2], and until 2016 the automobile production in China should increase by 10 % or even more [3] each year. In 2013 more than 22 million vehicles were built in China, the demand for wiring systems amounted to more than USD 1.4 billion [4].

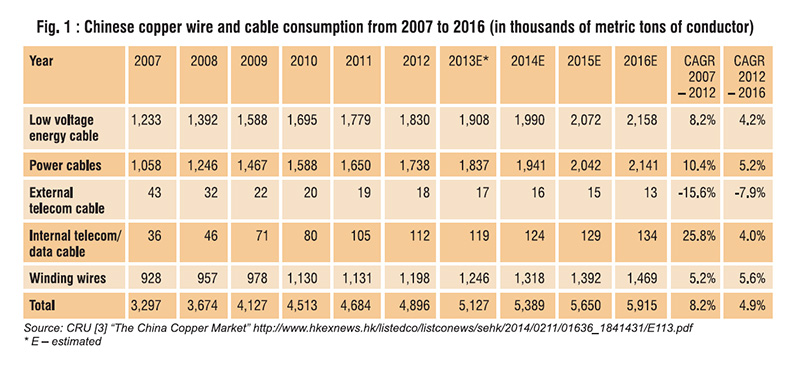

Since 2002 China is the biggest cable manufacturing country on the earth in terms of volume [5]. As noted in the “The China Copper Market” study published in February 2014, there are more than 7,000 cable factories with more than half of them privately owned [3]. The Chinese consumption of copper wire rod increased in the period from 2007 to 2012 with a Compound Annual Growth Rate (CAGR) of up to 11.5% and exceeded the Chinese copper wire rod production (10.1%). Reasons for this development are an increased demand for low-voltage cables as required for building installation, household and other appliances, and vehicles as well as the demand for power cables (Fig. 1). The power cable sector records the strongest growth rates. In the period from 2007 to 2012 its CAGR increased to a value of 10.4 %; according to the “Power Cables Market in China 2014-2018” study it is to be expected that the Chinese power cable market will increase by more than 8% each year until the 2018 [5], while the domestic Chinese consumption will slow to 5.2% (see Fig.1).

India

India’s gross domestic product (GDP) grew in real terms by only 4.9% in the fiscal year 2013-14. For the current year analysts expect a plus of about 5% [6].

For many years the development of the urban areas was of primary importance. From now on, also the rural areas should be taken into greater account. For this holistic approach the artificial word “rurban” – derived from “rural” and “urban” – arose [7]. Along certain industrial corridors infrastructure and industries should be extended so that 100 new cities can emerge. In the medium term the weakly developed eastern parts of the country should be led closer to the performance of India’s economically stronger West and the railway system being an important link in the transportation infrastructure should be extended. The Indian government wants to connect the biggest metropolises of the country to one another with high-speed trains. The first such line between Ahmedabad and Mumbai should go into operation by the end of 2017.

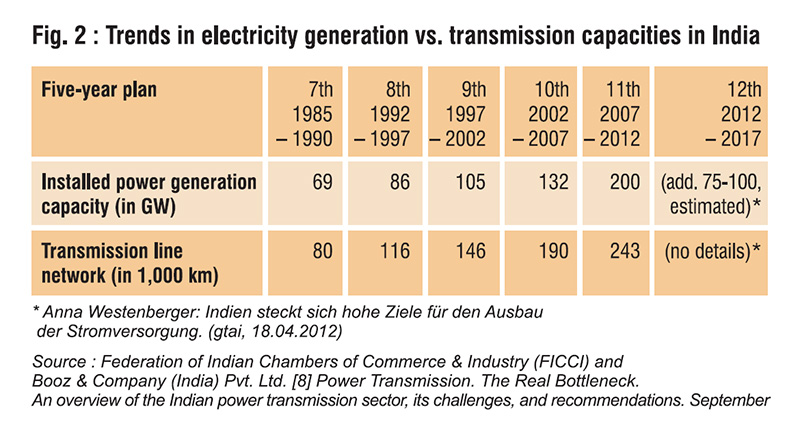

In order to cover the rapidly growing power needs and to reduce the high dependence on raw materials imports, India will make greater use of renewable energy sources. Up to now the transmission system has been considered as major bottleneck (Fig. 2) [8]. The study “More power to India: the challenge of electricity distribution” recently published by the World bank emphasizes that the electricity supply is unreliable and more than 300 million inhabitants have no access to electrical current at all. However, the economic growth and the increase in the competitiveness depend on the quality of the power supply [9]. In June 2014 the Indian government has approved nine projects to build nine inter-State transmission lines to a total value of about USD 2.75 billion. In this way the transmission capacity between individual federal states should be increased from currently about 28,000 MW to more than 66,000 MW by the year 2017.

The weak economic growth and a delay in the realisation of infrastructure projects made a significant contribution to the fact that the domestic demand for passenger cars and commercial vehicles has collapsed in the period 2013-14 by 6 and 20% respectively and consequently also the demand for automotive parts. Numerous car manufacturers and their suppliers nevertheless continue to adhere to their expansion plans [6]. The market research company IHS Inc. expects that India will become the world third-largest automotive market behind the PR of China and the USA by the year 2017 and until 2020 the world’s fourth largest car manufacturing country behind China, the USA and Japan. Although the study was published in July 2013, the car manufacturer Chrysler quoted its first key message in a press release in June 2014 on building up and expanding the Indian market for the Chrysler brand Jeep [10].

[1] PRC global leader in developing renewable energies.

[2] Chemical industry in the PRC is investing heavily in new equipment.

[3] Research Report on The China Copper Market.

[4] Research Report on Automobile Wiring Harness Industry in China.

[5] China Power Cables Market Report.

[6] Katrin Pasvantis: Economic trends in mid-2014 – India.

[7] The objectives of the Government modes are slowly being revealed. India News.

[8] Power Transmission. The Real Bottleneck. An overview of the Indian power transmission sector, its challenges, and recommendations. September 2013, Federation of Indian Chambers of Commerce & Industry (FICCI) and Booz & Company (India) Pvt. Ltd.

[9] World Bank: More power to India: the challenge of electricity distribution.

[10] www.livemint.com/industry