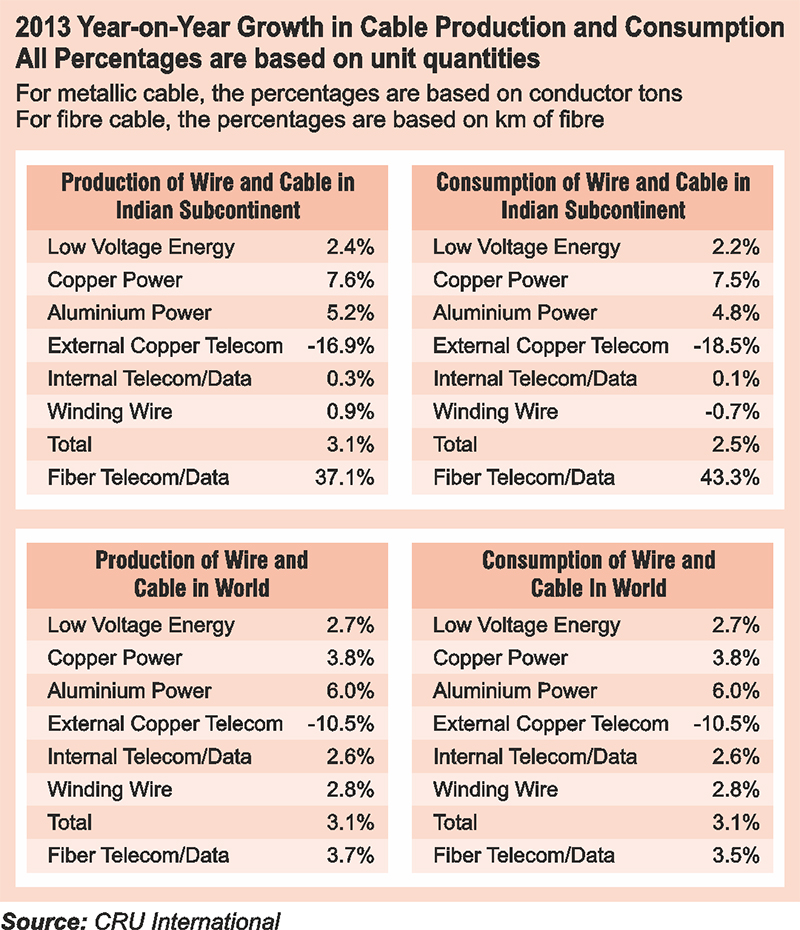

CRU’s assessment of the insulated wire and cable and fibre optic cable markets in 2013 reveals that metallic wire and cable consumption in 2013 was 3.1 per cent higher than that in 2012. Optical cable consumption was up by 3.6 per cent. The metallic cable percentage is based on the quantity consumed in terms of conductor tons. The optical cable percentage is based on the amount of fibre in cable that was installed in communication networks during the year.

In most countries and in most segments of the cable market by type of cable, there is no significant accumulation of cable inventories or no difference in the year-end inventories from one year to another. As a result, the quantity of cable consumed generally is equal to the quantity of cable produced in a specific year. There have been some exceptions to this with fibre optic cable in some years. This means that the amount of cable produced in terms of conductor tons increased by 3.1 per cent in 2013.

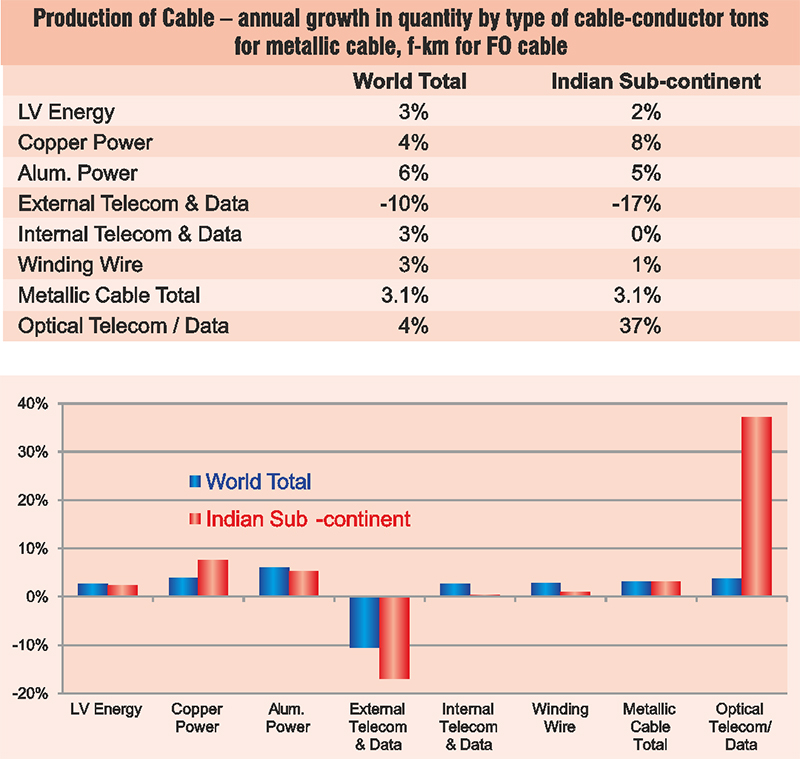

CRU publishes its data on global metallic cable markets four times every year in its Wire and Cable Market Outlook. This quarterly report includes data on six main types of metallic cables, as shown in Figure 1. CRU’s practice in its Wire and Cable Market Outlook reports is to select two major countries of geographic regions for detailed coverage in each quarterly edition. This means that CRU publishes detailed information on the cable manufacturers and cable customers of India every two years. In each regularly quarterly edition, CRU covers the consumption and production of cable in a region referred to as the Indian sub-continent, which includes India and neighbouring countries such as Bangladesh, Pakistan and Sri Lanka.

India’s economy dominates the Indian Sub-continent region. Its cable consumption and cable production are more than 90 per cent of that of the region. India’s share of the sub-continent region’s cable production by cable type in the early years of this decade was as follows:

The 2013 global metallic cable market’s year-on-year growth rate was similar to the global market’s increase from 2011 to 2012, but lower than the 20-year historical average annual growth rate of 4.1 per cent, going back to 1992. Rob Daniels, CRU principal consultant and lead author of the Wire and Cable Market Outlook, said, “There was a slight upturn in the last quarter of 2013, but no major shocks considering the market’s performance as the year progressed.”

Mr. Daniels noted that China’s growth in H2 2013 was better than market participants had expected, especially after a comparatively weak first half. Europe’s consumption of wire and cable, on the other hand, had been expected to show some improvement in the second half, but the region’s economy did not improve as hoped and cable demand for the full year fell short of earlier forecasts. For the full year, Europe’s cable market posted a negative year-on-year percent change in 2013, although the downturn was less severe than in 2012.

The report’s data on world production by cable types show that aluminium power cable had the strongest year-on-year growth in 2013 – 6 per cent compared with the average of 3.1 per cent for all cable types, based on conductor tons. The substitution of aluminium conductors for copper on power cables makes a partial contributor to the growth in this segment, but the main driver is the increasing investment in new power generation and transmission facilities, such as wind farms. Aluminium cables often are used to connect wind turbines to the grid, and this is a relatively new and high-growth application sector.

CRU’s metallic cable data for the Indian Sub-continent show that copper power production increased 8 per cent from 2012 to 2013 in terms of conductor tons. This increase was the largest among the metallic cable types for this region. Optical cable production for the India Sub-continent increased 37 per cent from 2013 to 2013. This growth, based on the number of fibre-km in the cable produced, outstrips the worldwide optical cable industry’s increase of 4 per cent.

India had several major telecom-network construction projects getting underway in 2013, requiring domestic cable manufacturers to step production. One of these, the National Optical Fiber Network (NOFN), will consume more than 10 million km of cabled fibre. This is the largest project in India’s history. The rate of construction for this project will be increasing through 2014. Other projects include installation of optical cable in the terrestrial networks of broadband-mobile-cellular networks.

The 4 per cent growth in the worldwide production of fibre optic cable in 2013 was the optical cable market’s lowest year-on-year growth since 2004. CRU completed its assessment of the 2013 optical cable market in February 2014 and published its findings in its Telecom Cables Market Outlook. The world total in 2013 was 253 million km of fibre – the first time annual demand has exceeded a quarter billion fibre-km.

Patrick Fay, a CRU senior analyst and the lead author on the Telecom Cables report, said that in 2004, the world’s optical cable market was recovering from a major multi-year collapse in telecom spending – basically a correction after significant overspending in the late 1990s, 2000 and 2001. As the recovery progressed from 2004 to 2012, demand in China and other key markets ramped up significantly.

From 2004 to 2012, China’s market grew faster than that of all other countries. As a result, China’s share of the world market increased from 24 per cent in 2004 to 49 per cent in 2012. Mr. Fay noted that the growth in China’s market during 2009 was so strong that it offset the effects of the recession in the rest of the world, driving a double-digit annual growth rate in the 2009 worldwide optical cable total.

As China is almost half the world market, its annual trend has a big effect on the world total. Mr. Fay said that China’s 2013 market growth was much lower than in recent years, due to some delays on the part of the country’s telecom authority in issuing key licenses needed for building the 4G mobile networks. The licenses were not issued until December, and this, in turn, contributed to delays on the part of China Mobile in placing orders for optical cable.

Mr. Fay pointed out that China Mobile is not only China’s largest customer for optical cable but it also is the world’s largest customer. China Mobile accounted for about 40 per cent of China’s 2013 optical cable consumption and 20 per cent of the world’s total. Unlike the mobile networks in the US and other countries, China’s three mobile companies have used fibre throughout their networks to tie the cellular antennas together and for all terrestrial and backbone traffic. Many other markets have a mix of fibre, copper and microwave links in their cellular infrastructure. India is like China, with significant use of optical cable in cellular infrastructure.