“We are also investing on new manufacturing facilities for irradiated electron beam (E-beam) processing to make various new products which can withstand higher temperature and are more abrasive resistant due to the cross-linking properties” – Mr. Deepak Chhabria

Mr. Deepak Chhabria, Executive Chairman, Finolex Cables Ltd. talks about the different growth drivers of housing wire, optical fibre cables and EHV segments, recent developments, growth plans, and the kind of contribution the initiatives like ‘Make in India’, ‘AtmaNirbhar Bharat’, ‘Digital India’ could make to the overall growth of the market in an exclusive conversation with Wire & Cable India.

Wire & Cable India: With this new normal how the business environment has changed and would evolve further? What are the challenges and opportunities you foresee for the wire & cable industry?

Deepak Chhabria: We, like most entities, have faced a temporary dip in our overall numbers on account of COVID-19. However, we see it as a transient phenomenon that we will be able to overcome as a result of the progressive policies and initiatives that are launched by the government. Our challenges remain the constant cost pressures that we face due to an increase in prices of copper and PVC, which are our primary raw materials along with the effects of the strengthening dollar.

As Albert Einstein had once said, ‘In the midst of every crisis lies great opportunity’. We, the wire and cable industry, have developed a ready base to meet the needs of the Indian market, and we should now target global markets. With negative sentiment against China prevailing globally and a large number of international customers looking for alternate suppliers from emerging markets — the Indian companies have the opportunity and potential to meet their demands. It can be accomplished by focusing on innovation, investing in design engineering and upgrading our quality to become globally competitive. The Government, on its part, can help in resolving infrastructure bottlenecks so that the products are competitively priced.

We have also seen a market opportunity in smaller towns as sales have been surprisingly robust from tier-2 and 3 markets. The rise in sales could be because people have travelled from the metros and are looking at doing up their homes or there was already a pent-up demand that we have been able to tap now because of the addition of retailers into our network.

“We have commenced on an ambitious plan of enhancing retail outreach to 1,50,000 outlets from the current base of 50,000 by the end of this financial year.”

WCI: Since different industries across sectors have been deeply impacted by the crisis ensued by the pandemic, the businesses have reassessed their approach and business operations. In what ways did you realign your strategies to stay agile and sustain in these evolved conditions?

DC: The Initial days of the lockdown were harsh, with production and sales at negligible levels. As a manufacturing entity in the non-essential category, the unexpected turn of events adversely impacted our fourth-quarter results last year. It affected both deliveries and our raw material supplies due to various logistic disruptions.

It was during June 2020, when production and sales started picking up, as our employees rejoined the work. We brought some people back by flights who had gone back to cities like Bengaluru, Kolkata etc. We also hired small minivans and cars to bring back people who stayed close to our places of work/offices. We got production work started with the trained operators.

Slowly things started normalizing, and today we are running at our pre-COVID operation levels. Process and systems set up over half a century during which we have overcome several challenges, speaks volumes about our ability to not only withstand tough times but also to come back stronger after every setback. The challenges may keep changing, but our Company’s DNA remains the same: to persevere and perform. This time, too, we shall overcome. We are taking decisive actions to help ensure our continued competitiveness, financial resilience and business continuity in the new normal.

“We will soon be introducing new solar cables and automotive cables that meet the emerging demands of the respective sectors.”

WCI: According to you what are the different growth drivers to drive the overall market performance in each of the segments — housing wire, optical fibre cables and EHV?

DC: Wire and cable industry in India comprise about 25 percent of the power transmission and distribution sector. It also forms 40 percent of the electrical equipment industry in India. Different kinds of cables like extra-high voltage cables, elastomer cables, etc., are now being used for special applications such as mining/oil sector, shipbuilding/crane cables/ elevator cables, cables for solar power plants, power cables to harness power for new generation projects.

The constant challenge faced by the industry is the rise in the price of raw material inputs like aluminum and copper. Though 65 percent of the industry lies with the organized sector, the rest of the unorganized sector provides stiff competition. Infrastructure development is likely to boost this sector. With the development of smart grid projects, highways and railways modernization, Digital India will give a fillip to the sector. Currently, the Indian per capita consumption of wires is only 0.5 kg, while the global average consumption is 2.7 kg. Clearly, the industry is expected to grow over the coming years.

Our CAPEX is directed towards enhancing production capabilities to meet the requirements of the solar power and automotive industry, bringing in-house certain value additions which were outsourced earlier and further expansion of the optic fibre line. We will soon be introducing new solar cables and automotive cables that meet the emerging demands of the respective sectors. Also, the construction sector, which accounts for 60 percent of our electrical wires and cables revenue, is poised for strong growth. The above range along with our new product PVC conduit allows us to start a business relationship with the project developer right at the initial stage after which wires, MCBs, switches, lighting will be required to complete the wiring in a home.

In the case of EHVs — the process of urbanization along with investments in the power sector is resulting in a large demand for high-voltage (HV)/extra-high voltage (EHV) power cables, as these cables help shift overhead transmission power lines underground.

Our ‘J Power Systems’ manufacturing facility is well equipped to produce EHV XLPE (Extra-high voltage cross linked polyethylene) insulated power cables as it is the only plant in India to have a 121m long vertical column. Since such power cables are installed in a trunk line of EHV power transmission grids in the urban areas, extreme quality and reliability are required.

We have been able to make entry to most of the utilities PAN India be it state utilities or private utilities. We are getting repeat orders from these clients due to our quality product and services. Moreover, we have been successful in exporting EHV cables to countries like Indonesia, Myanmar, Kuwait etc. Thus, helping the government meet India’s Atmanirbhar initiative. We have successfully supplied 220 kV EHV cable and completed the project from M/s Delhi Transco Ltd., which was a PMO monitored project. We are executing a 230 kV cable supply and installation project in Tamil Nadu (TANTRANSCO).

“We have successfully supplied 220 kV EHV cable and completed the project from M/s Delhi Transco Ltd., which was a PMO monitored project. We are executing a 230 kV cable supply and installation project in Tamil Nadu (TANTRANSCO).”

WCI: Has there been any new development at Finolex Cables that you would like to share? Are there any aspirations to expand your capacity in the near future?

DC: Intending to reach a turnover of INR 10,000 crore over the next five years, Finolex has increased its focus on growing the electrical consumer product range of fans, water heaters, lighting, switches and switchgear segments. In line with our aim of providing a complete solution to customers, Finolex has been launching a steady stream of products even during the pandemic period. In the fan category, we have introduced anti-bacteria and anti-dust fans that protect consumers from harmful bacteria and germs. These fans are coated with a paint containing low toxicity biocides for complete protection against microbiological growth, by repelling microbes or killing them when they come close to the surface. It also resolves the inconvenience caused by the cleaning of fans, making it a truly hassle-free solution for the consumers.

To meet the market demand for the coming winter, we have introduced immersion rods and the attractively designed Jubito Plus storage water heaters. We are in the process of launching IoT enabled lighting and fan products that can be retrofitted onto existing switches, thus ensuring that the latest in smart technology is available at affordable price points.

Going ahead, we will continue to expand offerings in electrical products and introduce new products across multiple segments to augment the scale and strength of our business. As the pandemic situation resolves over next year, we also see increasing investments being made in the development of the healthcare infrastructure, a segment that we are primed to serve with our complete range.

We are simultaneously working to ensure our products are available at maximum store shelves across the country. Keeping in line with the above objective, we are increasing our reach by setting up a robust two-tier distribution model. Aligned with this strategy, we have commenced on an ambitious plan of enhancing retail outreach to 1,50,000 outlets from the current base of 50,000 by the end of this financial year. As part of our efforts in engaging with the customers, we are in the process of setting up 50 Finolex Houses. These are exclusive stores from which our complete range of wires, cables along with our appliances are displayed and sold.

WCI: How do you think the future years will pan out for Finolex Cables? What are your growth strategies?

DC: Our state-of-the-art manufacturing facilities have been one of our greatest strengths. We continue to invest in maintaining this strategic edge. Our CAPEX is directed towards enhancing production capabilities at our Urse and Goa plants. We are focused on nurturing separate verticals of lighting, switches, switchgear, fans and water heaters and will soon be launching electrical conduits. We would like to see each of these verticals grow into stand-alone businesses of INR 250-500 crores. The wire and cable growth will be additional.

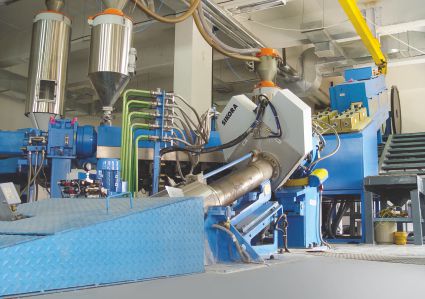

We are also investing on new manufacturing facilities for irradiated electron beam (E-beam) processing to make various new products which can withstand higher temperature and are more abrasive resistant due to the cross-linking properties. We are also expanding our communication cable segment by adding capacity in coaxial, LAN and fibre optic cables. Besides, we are also focusing on expanding the distribution reach to grow our LDC product range. A new plant to manufacture PVC conduits is under construction at our Goa facility and expected to go on stream in the next two months. This will allow the Company to start a business relationship with the project developers right at the initial stage after which wires, MCBs, switches, lighting will be required to complete the wiring in a home.

WCI: As manufacturing operations, when streamlined by lean methods of production is one of the key factors in making the business more efficient and responsive to market needs; how do you strive to make your operations more efficient and productive to derive even more value and enhance your competitiveness?

DC: Customer expectations have been changing. It’s a reality that affects the very core and future of our supply chain operations. Without a real-time view into demand, inventory, bottlenecks, one can risk losing customers who want to buy from a retailer.

We, at Finolex, have been investing in IT and data management system (DMS) for many years. It is an intelligent fulfillment platform that allows one to orchestrate the entire fulfillment network with powerful core capabilities. Our DMS connects not only our branches but also our distributor systems. We can thus ensure stock availability across branches and distributors along with the ability to get up-to-date views on what’s available. This ensures the system works on replenishment mode where we have assigned safety stock as per the average branch sales. The system is programmed to refill after the stocks are sold. The generated data works as a close bridge between our factories and the channel partners. The accuracy ensures that we produce as per the actual demand, and movement of inventory is fast and efficient.

This way, we ensure each interaction lives up to the ever-evolving customer expectations, and inventory visibility starts from the entry point. Without real-time views into inventory, we risk losing customers who will find alternative brands. The supply chain and fulfillment challenges that we are currently facing and working around are further amplified during the pandemic. Keeping into account changing dynamics due to COVID-19, we have modified our algorithms to minimize supply chain disruptions.

“Intending to reach a turnover of INR 10,000 crore over the next five years, Finolex has increased its focus on growing the electrical consumer product range.”

WCI: The government initiatives such as ‘Make in India’, ‘AtmaNirbhar Bharat’, ‘Digital India’ etc. are anticipated to drive the demand and propel the growth of the wire and cable market. How do you perceive the kind of contribution these initiatives could make to the overall growth of the market, keeping in view the major expectations of the manufacturers from the government?

DC: AtmaNirbhar Bharat, Bharat Net, Digital India and smart cities projects are promoting self-reliance while encouraging a thrust to digitization. It gives India an opportunity to build an economy that is more resilient and diversified for meeting the demand of Indian and global audiences. We are predominantly operating in business segments that are core to the government’s key focus areas which include infrastructure development initiatives, thrust on digitalization, electrification of rural villages and households and improved consumer spending. All initiatives that will spur growth and bring demand from household, commercial, industrial, digital and telecommunication segments including the allocation of highest ever capital expenditure of INR 1.6 lakh crores for railways too will augur well for the company. We have seen the demand shifting temporarily from metros and mini metros to tier 2 and 3 towns. We have accordingly started investing in increasing our network and are in the process of signing up 150,000 retailers by the end of the year.

In today’s digital world, we recognize that a customer’s buying patterns are changing. We are, therefore, emphasizing on our e-commerce platform as an option for them to shop online seamlessly. Our digital marketing strategy is devised to drive traffic to our e-commerce platform, and we find a growing number of visitors on our site. Using usage analytics on our e-commerce site, we are constantly upgrading and updating it to enhance deeper interactions and usability.

We have recently launched two applications — Finolex Smart Wiz and Finolex Cable Calc. Finolex Smart Wiz is an AR (Augmented reality) APP that serves as a one-stop-shop for consumers who are constructing or improving homes — thus enabling them to get a first-hand feel of the Finolex range at their fingertips along with the opportunity to buy products directly from our e-store. The augmented reality feature helps the customer superimpose fans, water heaters, switches and lighting product pictures into their home/office environment by creating a composite view. This way, they can check if it matches their house/bathroom décor and then makes their selection.

Also Read: Union Budget 2021: Wire and Cable Industry Views.

Finolex Cable Calc is a platform designed to provide a tool with our electrician partners for calculating the cable and switchgear requirements of a project effectively. The application recommends the size of the wires and cables that should be used in a project based on the electric load that is keyed into the application by the users along with other relevant details. It not only recommends the cable and MCB requirements for a project in the residential and commercials segments; it also suggests required cable ratings for powering a submersible pump. With this application in their hands, cumbersome calculations are made easy to work out. Recognizing the increasing trend of customers shopping online, we have added Amazon to our arsenal and are exploring other e-commerce sites too. With our products now available on Amazon, we expect consumers from the interiors accessing us at their convenience.