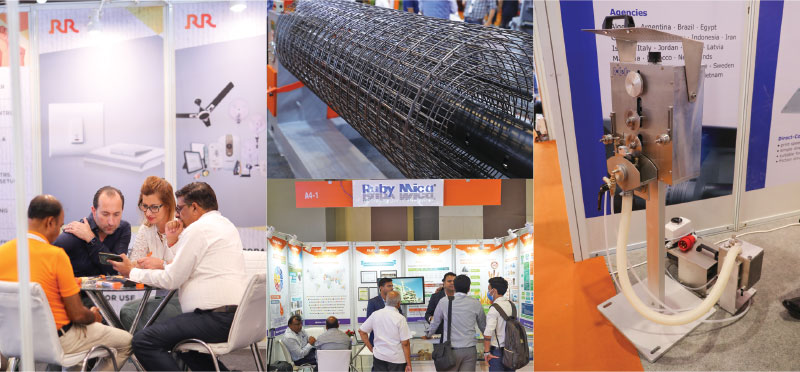

The 4th International Exhibition & Conference for the wire, cable, and allied industries, Cable Wire Fair 2022, was held from 18 May-20 May, 2022 at Pragati Maidan in New Delhi.

InaugurationAfter a three-day run that threw light on the wire, cable and allied industries, Cable & Wire Fair 2022 concluded successfully. Organised by Tulip 3P Media Pvt. Ltd., the International Exhibition & Conference for Wire & Cable Industry registered a footfall of over 12000 visitors from India, Algeria, Azerbaijan, Bangladesh, the Democratic Republic of the Congo, France, Ghana, Iran, Italy, Japan, Kenya, Malaysia, Malta, Nepal, Nigeria, Oman, Qatar, Republic of Korea, Russia, Rwanda, Saudi Arabia, Singapore, Sri Lanka, Tanzania, the Netherlands, the United Arab Emirates, the United Kingdom, Uzbekistan and Zambia.

The 4th edition of the Cable & Wire Fair was held from 18th to 20th May 2022 at the newly constructed halls at Pragati Maidan, New Delhi offering the best opportunities for networking & marketing of new technologies, latest products and innovations in the wire and cable industry. After receiving an overwhelming response from the industry, the event, this year, showcased the products of around 200 exhibitors from different countries across the world.

Meanwhile, the conference kick-started with the inaugural session addressed by key dignitaries – Mr. Anil Gupta, Chairman & Managing Director, KEI Industries Ltd., Mr. Shreegopal Kabra, Managing Director and Group President, RR Global, Mr. Anurag Pandey, Executive-in-Charge, Global Wires India – Tata Steel, Mr. Vijay Karia, Chairman & Managing Director, Ravin Group and Mr. Sandeep Aggarwal, Managing Director, Paramount Communications Ltd. and Mentor-Telecom Committee, PHD Chamber of Commerce and Industry.

Electrifying Future Ahead

Mr. Anil Gupta set the tone for the proceedings and said, “It is a very momentous occasion for the wire and cable industry. As we all know, we have been through two very tough years of operating in an environment caused due to the COVID-19 pandemic, which led to the frequent disruptions in the factories as well as the products’ side, which means the user sector.

As I see the current scenario of the wire and cable industry, it is quite challenging due to the sharp rise in the inputs’ costs, and the supply chain disruptions due to the unavailability of containers for imports and exports. For similar reasons, the execution of projects, whether in large-scale projects, or house constructions – both have suffered due to lockdowns and the lower availability of skilled manpower, either at factories or at sites. This led to the slower execution as many of the contracting companies suffered because of the firms’ contracts taken from the government and the private utilities.

However, on the positive side, we are witnessing a good pipeline of projects, from the government CapEx as well as the private CapEx, with a very broad-based growth across all the sectors. The Government of India has announced an infrastructure investment of INR 7.5 lakh crore this year in various sectors of the economy, which is further supported by an uptake in private CapEx in the industry as well as supported by the construction and the Real Estate sector, in particular, the Prime Minister Awas Yojana. This has become possible due to corporate balance sheets becoming deleveraged and revival of many sick plants due to their resolutions through insolvency and bankruptcy.

Many sectors such as real estate are giving ample confidence to the investors, through strict regulations like RERA. The prospects of private CapEx are further boosted by the lower interest rates offered by the banks and the Production Linked Incentive Schemes offered by the government in the infrastructure projects and private CapEx.

The pipelines of the government’s infrastructure projects in the Oil & Gas sector capacity upgradation and the fuel upgradation, the metro rail, and the sub-urban rail projects, the underground cabling projects of the transmission & distribution, including the conversion of the overhead transmission lines into underground cables, and the construction of the new airports, roads, and highways. This has led to a significant improvement in demand in the wire and cable industry.

Further, as a future outlook, I may emphasise that due to the ‘China plus one’ policy adopted by most of the developed countries, the Indian wire and cable industry can benefit from exports to Europe and North America, and other developed markets, if they strive to obtain necessary quality certifications, in those countries. In most countries, the solar and wind farms are leading the CapEx, which can benefit and boost the demand for the wire and cable industry. The industry can also benefit and grow rapidly if they scale up investments to make their manufacturing plants internationally viable, and with international quality of plant and machinery, and the quality management systems in the production, and also invest in the automation of their factories. The challenge of the industry is to develop a strong skilled workforce, technical manpower, and consistent innovations in developing new products, with respect to the market demand in India or overseas markets.

The industry can also explore the opportunities out of free trade agreements entered by the government in many developed countries, on seizing new opportunities.

I am sure that with the COVID being the past, and looking at the large opportunities ahead and for building an ‘Atmanirbhar Bharat’, the wire and cable industry will go a long way, and will become a significant player in the country’s economic growth.

This is almost an INR 70,000 crore industry, at the moment. And if we are able to grow by at least a CAGR of 15 percent, in the next four years, we will be able to reach a level of INR 1.5 lakh crore, which means being in an industry of USD 20 billion – hence, becoming a significant part of the economy, driving the growth.

I am sure that these milestones will be achieved, given the scale of the economy and the boost in infrastructure that the country is witnessing and going to witness.”

Meanwhile, Mr. Shreegopal Kabra emphasised on the quality of wires that should be used. “To become a global player, as a country, we need to focus on quality and safety.

Of all the fire accidents, about 70-80 percent are electrical, and out of these electrical fire accidents, about 70-80 percent are due to the wires and cables. In the future, only the companies which have been focusing on the right quality are going to grow. It is high time for the entire electrical industry to come together and really work for the safety of the nation and the people,” said Mr. Kabra.

Mr. Anurag Pandey appreciated the government’s focus on the infrastructure, auto sector, and the rural economy which is boosting the growth of the steel wire sector, “In the last two years, there has been a huge disruption in the way the businesses were done. Health and safety have become the prime concerns. Earlier, while we used to talk about health, it referred to physical health, but now we mainly talk about mental health. While we all were working from home, the concerns which were there pointed to the significance of caring for mental health.

As we aspire to become a USD 5 trillion economy. The export would play a critical role. We all look towards the western world, for some of the critical equipment. That is where the challenges lie and the government is trying to incentivise through the PLI schemes.

But I think it is a fundamental change that we all are trying to make quality products because we want to become an export-oriented economy.

As a representative of the wire industry, I would like to talk about the government’s focus on the infrastructure, auto sector, and the rural economy is playing a fundamental role. The wire industry is the closest to the customers, in the steel value chain; we are very close to the end-consumers, whether it is with regard to the fencing wires, or tyres. And we expect that the growth rate is going to be in double-digits.

We need to focus on the quality products and exports, while the domestic industry continues to be dominant. When we are talking about the future outlook, and we have to compete with the international players, we need to produce products of international quality standards as well. When we design and develop technologies, the global markets and their standards have to be kept in consideration.

The second fundamental shift is towards the focus on sustainability. I think safety is one aspect which is being focused upon, but the concern of sustainability – the government’s focus on emissions, the usage of various kinds of acids, which we have in our industry and which are easily accessible.

But going ahead, in the next decade, if we want to compete with the international players, it would be imperative that we start talking about sustainable operations. The newer technologies which are coming up need to be adopted in our systems.

Our Prime Minister keeps on talking about that 5-0 percent of our population comprises women. We, at Tata Steel, which is part of the Tata Group, have a significant number of women in the workforce, which is even growing. There has been a paradigm shift which is happening in the industry. It is not only the white collar jobs for which we can hire women, but we can give them equitable opportunities to work in various kinds of job roles. We should realise that the issue of diversity in the workforce is going to be an important factor in the future.

Last but not the least, I would like to talk about the issue of digitalisation – whether it is Industry 4.0, internet of things, data analytics, big data, robotics are disrupting the way we used to work earlier. It is important that we start investing in digitalisation and digital innovations. After the easing and lifting up of COVID-19 lockdowns, we started to realise the importance of the digital way of working. These are the fundamental shifts which have happened in the last two years.

I think the Indian wire and cable industry is at the cusp of becoming an international-level player. In the next ten years, I think, when we talk about buying technologies and machinery, the way Indian startups are coming up, we will have a scenario that the people will come up and shop from India for their requirements of high-end machinery,” he said.

Mr. Vijay Karia from Ravin Group highlighted the safety and sustainability issues and requirements in the wire and cable industry, “We talked about various issues of the industry like safety and sustainability, as well as the growing markets, and the future outlook.

What we need to do and realise is that the issues of safety, sustainability and the mode and the method of doing business should be internalised. I think the safety of the industry starts from ourselves, from the way we conduct our business and the way we do our businesses. Similarly, sustainability does not imply that one becomes a zero emission industry or a zero emission company, but the idea of sustainability starts when the business is sustainable in all respects. When the company is able to do business on its own terms and is able to get money on time.

The industry, despite all this, has grown and reached a global level as the industry exports to a lot more countries than it was exporting to, a decade or two ago. Our markets have witnessed significant growth. This has been made possible because of all the people, who are a part of the industry. The industry has grown and become very innovative in terms of doing businesses, attracting customers, and so on. Along with affordability and price sensitivity being big issues, another constant issue in the industry is making quality products, which are sustainable as well. The concept of ‘sustainability’ is not just about the environment, but it means that the company or the industry is able to sustain itself.

As we go along, we are going to see a lot of changes. The industry needs to get together and work towards the improvement of the products and services. All in all, I think that we need to be happy with the way the industry has grown. The wheel has turned a full circle. Today, we are getting a lot more projects from the government sector. The private industry has shrunk a bit. I am sure that with the pace picking up, we, the people of the cable industry, are set to have good times. So, I am sure that we will only get better. And by the next edition of Cable & Wire Fair, I hope that some of these issues are being addressed and resolved in the industry. We look forward to associate for a bright and electrifying future!”

Speaking on the occasion, Mr. Sandeep Aggarwal added, “Today, I am representing the PHD Chamber of Commerce and Industry, which is a very old industry body – one of the initial and first industry bodies in the country. We are an apex chamber, representing about 1.5 lakh people – companies – directly or indirectly. As an association which looks after the interests of all the companies in the economy, we wish and want to work together for the upliftment of the economy and the industry, in a way that we reach the goal of becoming USD 5 trillion economy, which has also being propagated and talked about by the Hon’ble PM of the nation.

Very soon, we will be seeing about 2.5-3 lakh crores of CapEx and O&M into the telecom sector. The govt. is planning to invest 1 lakh crore into putting optical fibre cable networks to the last village, and FTTH to every single institution of importance in every village. This is going to prove to be a game-changer and revolutionary.

The net worth of the Indian industry is around INR 75,000 crore. And the CapEx being done by the government in the Budget 2022-23 is INR 7.5 lakh crore. Along with the investments being made by different Indian states and various industries, with the National Infrastructure Pipeline 2025, the government’s aim is to invest INR 113 lakh crore (~USD 1.5 trillion) into our economy, that is, the capital investments of – the infrastructure and the social investments.

With the proposed investment of USD 1.5 trillion into the economy, it is evident that the wire and cable industry would be the biggest gainer. Today, the wire and cable industry accounts for about 0.4 percent of the GDP, it means the Indian wire and cable industry is about INR 75,000 crore.

But in the infrastructure segment, it is 2-3 percent, and since this huge investment of USD 1.5 trillion will be infused in the next five years, we are going to see a huge leap in the scale of the companies in the domestic wire and cable industry.

The government, in association with the wire and cable industry, will have to ensure that they are producing the right quality, the right product for the right purpose, to make sure that the projects we put our efforts into, bring in the desired results. Then, the industry will be able to benefit the economy and vice-a-versa.

As an industry body, PHD Chamber of Commerce and Industry is working hard towards the growth of the industry and we have seen that the ease of doing business is a major concern.

The biggest problem that we are seeing in the industry is the PSUs delaying the payments of the industry. We have been having meetings with the PSUs in the telecom sector – the chairman of BBNL, the chairman of BSNL, the secretary of Telecom, and so on.

In our meeting with the Finance Minister, we suggested a new kind of PBGs (Performance Bank Guarantees), which is an insurance-based PBG, and she welcomed our suggestion. It is going to be a game changer and lead the industry towards saving thousands of crores, in the performance bank guarantees limits from the banks.

Thus, the banks have been charging heavily to the industry, and in many cases, charging 100 percent as back up money with them, especially with the small and the medium scale industries. This is really going to change the way businesses are done, because the industry will have funds-free to do business, rather than to keep them as FDs in the banks.

We are also working on the duty reduction. In the last two years, we have seen that the prices of the basic materials – copper, aluminium, PVC, steel – have all gone up by 100-200 percent. Right from April 1, 2020, we have seen these kinds of incessant increase in the raw material prices. We have recently proposed to the government that the duties levied on all these materials should be made zero, considering their high prices. This is what is needed to make India into a USD 5-10 trillion economy.

If we are paying heavy custom duties, we become inefficient in our exports. Seven out of ten companies in India are not able to import duty-free raw materials, even though they can, because of the volumes, and other factors. The duty reduction will not impact your sales or your balance sheet or the bottom-line growth.

While we are able to import duty-free materials, it is when you price your product; you are pricing it based on duty-paid costs, because you assume that 80-90 percent of your buyers will buy it on full duty. Therefore, we are importing into the country. And the imports are harming our economy, while your sales are also reduced by that much amount.

Conglomerates like Sterlite, Reliance and Hindalco are also going to grow in sales and size with the reduction of duties to 0 percent. If the Indian economy moves up, if our sales go up by 2-3 times, your sales will go up by 3-4 times.”

The vote of thanks was presented by Mr. Priyank Jain, CEO, Tulip 3P Media, the organiser of the event- Cable & Wire Fair 2022, “It has been an overwhelming situation for the organisers to host the event after a gap of over two years, caused by the pandemic. In fact, we could sense a feeling of excitement amongst various exhibitors as well as visitors coming to the event. And we are happy with the same!”

The inaugural session was followed by the first panel discussion on ‘Wire and Cable Industry Outlook’. The session discussed the success stories and how they can shape the future of wire and cable industry. The panelists in the discussion included Mr. Ashish Chaturvedy, Head of Marketing and Communications, Ducab, Mr. Benoit Lecuyer, CEO, Prysmian India, Mr. VK Bajaj, Senior President-Business Strategy and Innovation, Apar Industries Ltd. and Mr. Abhishek Gupta, Joint Managing Director, Gupta Power Infrastructure Ltd.

Renewable Energy – A Growing Segment

Mr. Ashish Chaturvedy began his speech, saying, “Ducab is owned by the Government of Dubai, and Abu Dhabi, with 50 percent equity respectively. However, we are very proud to have our roots ingrained very well within the Indian subcontinent. We are a diversified group of wire and cable business. The metal brand that we rechristened about two years back – called DMB, holds the pedigree from the parent business.

Both the plants for the wire rods as well as the copper rods and the aluminium rods are based out of the UAE, but we have presence in about 40-45 nations all across the world, as far as Far East Asia, Australia, parts of Northern Europe, and Northern America, are the areas which we are supplying. Thus, we take utmost pride in the fact that our products are being produced within the UAE, but are being used and supplied in each of these markets, including the Indian market.

Ducab Copper Rod business has 180,000 tonnes capacity. The plant is based in Abu Dhabi, running on the south wire technology for the last twelve years. We have been producing high-quality ETP rods that have been indeed supplied to many of our friends in the Indian market for many years now.

The prices of metals like copper and aluminium is something that each one of us is struggling with. We don’t know which direction this will be heading towards. The point is that the volatility in the commodity market, whether it is the COVID-19 lockdown in China, whether it is the Ukraine War or is it the overall supply chain glut, this is going to remain with us for an uncertain period of time. Therefore, the uncertainty in our markets is continually going to remain. And that is one of the biggest challenges for the industry to manoeuvre and find ways to operate within these challenges to the best of our ability and overcome these challenges.

Coming to the wire and cable market globally, the industry is thankfully still being benefitted. The industry has been growing and it continues to expand in areas where we hadn’t heard in the past. We are now looking at about USD 220 billion of wires and cables globally. Out of which, the Middle East region happens to be taking just under 5 percent. Thus, the Middle East market is about 900,000 tonnes. To put this into perspective, our studies estimate the size of the Indian market to be around 1.4-1.5 million tonnes of wire and cable consumption.

The subset of the Middle East is the Gulf Cooperation Council (GCC) – union that consists of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Within this segment, Saudi Arabia is found to be occupying the largest share, followed very closely by Turkey, and then Iran, the UAE, Bahrain, Kuwait, and so on. In terms of the overall production of the region, it is a fairly robust self-reliant industry.

When we look at the energy pipeline in terms of the requirement of the wire and cable, renewable happens to be one of the fastest growing segments, and that’s where a large component of demand for wires and cables are coming in. Saudi Arabia takes up the top position. A huge number of projects in solar and wind energy are being planned. Several of them are well underway. All in all, there are enough awarded and unawarded projects, largely in the renewables domain. But taking a step back, this hasn’t happened by default. This is all happening by design, where the leaderships of each of these countries have been working on these plans for several years now.

When we look at the clean energy targets of each of these countries, they are phenomenal, and by no means, they are belittling any of the targets in wider, more advanced economies, and developed parts of the world in the West. You will witness a huge amount of solar and wind power generation and subsequently, its transmission and distribution, which are going to be available not just in Saudi, but also in the UAE, Kuwait, Bahrain, and Oman, in times to come. For a quick background, 5 percent is the yearly rise in the Middle East. By the way, with regard to the per capita consumption of energy in the world, Kuwait and Qatar are sitting right at the top. This is because of these major reasons, there are enough subsidies available, far greater in any other part, and also because of the propensity to spend, and the disposable income available in those markets, for huge revenue that these countries would generate from their hydrocarbon sales to the rest of the world – as one of the reasons. But consciously, they have been making a lot of efforts to try and move away from the dependency on hydrocarbons, and try to invest in a cleaner future. And that is the reason why you’ll see none of these figures are in megawatts and most of these are astounding figures, in gigawatts.

I would like to conclude my session by referring to the deal signed between the Government of India and the Government of UAE. And thanks to the leadership of both these countries, the target for 2030 in terms of bilateral trade is expected to go up from about USD 60 billion to USD 100 billion. Also, about 90 categories of products and services are going to be tariff-free, between both UAE and India. However, given the announcements that both the governments have made so far, there are enough and more opportunities for both the UAE and India to be able to invest, and import/export, and develop in many other categories and industries which have been hitherto restricted by the types of tariffs, or the import/export barriers which may have been created in the past. And this applies to a wide range of products and applications, not just the electrical domain.”

Speaking on the occasion, Mr. Benoit Lecuyer, CEO, Prysmian India said, “I would like to talk about some of the trends applicable worldwide and very much in India. It is the need of the hour which is to consume less and better. We have only one planet. We need to think of the next generations, and we need to be carbon-neutral! The Indian government is very much ahead and is leading the world. With the strong engagement of Prime Minister Narendra Modi at COP26, the vision of India being carbon-neutral by 2030, which means being twenty years ahead of some countries, was put forth. To some extent, sustainability, which is an overriding concern for us, is very much in place worldwide and in India.

I have tried to emphasise upon sustainability in three main KPIs, including, renewable energy, decarbonisation, and grid resilience. For solar energy, it is clearly a success in India. We know that we are already having 40 GW of solar energy. The aim has been laid to take this to 200 GW by 2030, including the solar rooftop. We are blessed in India to have 300 days per year of sunny days. It is a very clean energy. By the way, renewable energy means that it is limitless, it renews by itself, and it is free of charge, and what costs us is in the means of harnessing and storage. A lot of efficient solar parks are in India, such as, Bhadla Solar Park, Kurnool Solar Park, Kadapa Solar Park, to name a few. For the cable industry, this brings a lot of potential for further growth for various segments like – DV cables, Low Volatage (LV) cables, High Voltage (HV) Cables, and so on. There are a lot of excellent EPC companies in the country including JSW, Adani Transmission, etc. We have superb potential in front of us.

As regards the wind energy segment, India is performing marvellously. India is blessed to have about 7,516.6 km of coastal areas. Of course, there is the challenge of onshore renewable land acquisition. But I think the government has laid down some policies for this to be extremely precise and clear now. There are huge wind parks operational in states like Tamil Nadu, Maharashtra, Gujarat, Karnataka, etc. The potential is immense, that is, 300 GW of onshore, and 200 GW of renewable energy. This also comes with hybrid energy models, comprising both wind energy and solar energy. The cable industry is altogether favourable of the Indian government’s policies. There is a lot of potential not only in control and instrumentation cable segments but in power evacuation as well, which could be either underground or underwater.

Geo-thermal energy is not that apparent in India, although we are blessed to have a lot of tectonic plates in the country. It is a pure renewable energy. And it is one country in the world which is already tapping 30 percent of the energy. We all know that as deep as we dig into the earth, the hotter it is, and the challenge is to tap this energy. The countries like Indonesia, Philippines, and Japan, are already working into tapping this energy. It may happen in the future in the country. In the cable industry, there are a lot of challenges regarding innovation, quality, and ability to withstand extreme pressures/temperatures.

Now, I would like to touch upon the tidal energy segment. Here, it is noteworthy that the pressure of the water in low and high tides is 80 times more than the air of the renewable energy. Thus, it will be much more efficient if we tap onto this energy. In this, we need high quality cables like submersible cables, power cables, etc. It is already effective in a few countries like France, where an area called Lagos is totally supplying tidal energy to the town. This can also be symmetrical to what we call – hydropower.

About decarbonisation, I feel that there is a lack of awareness amongst people. But this is already quite prevalent in India. Since carbon emissions are one of the leading problems worldwide, we have different ways to use energy that can emit less carbon. There is also this technology wherein mega fans are installed to absorb the carbon from the air, and recycle in order to get some carbon pellets. And after that, the town is cleansed. This is utilised in the country by Tata Group, which is the first company in the country to use this concept. The downside of this is that it is often installed by the oil & gas industry as they strategically store the carbon in the earth in order to extract more oil.

For the electric vehicles segment, we all need to be powered up! There are about 500-600 electric buses. It is a reality! We already have 500-1000 three wheelers. Also, India is the first country worldwide in terms of electric rickshaws. I have observed a lot of food delivery platforms using electric vehicles for their food delivery services. It is a very smart move by ISRO to manufacture lithium batteries in order to not be dependent upon imports. Combined Charging System (CCS) is a standard technology well in place. And for electric buses, a lot of companies have already implemented it.

Grid resilience simply means how the power generation, transmission, and distribution can withstand the huge natural catastrophes like typhoons, storms, etc. The grid resilience means to do preventive maintenance, inspections, etc. Also, it means installing a lot of intelligent monitoring devices that notifies of the fragile points.

Smart grids are basically the communication exchange between the utilities and the users, viz., home owners, industries, smart cities, etc. This is in order to predict and collect data in order to plan in advance the energy distributions, for some thermostats, smart devices, smart meters, and so on. For instance, on a sunny day, a factory may not need to be connected to the grid. But to do that, a smart grid is needed. Also, for charging stations, a smart grid can anticipate when one needs to charge. So, the smart grids have a huge future. It is already being implemented in many countries around the world, including India. It is based on having predictability in order to reduce the stress on the grid.

Then, one element which is crucial in the grid resilience is passive discharge identification of the cables. We all manufacture excellent quality cables. But we all know that due to third parties, there could be any kind of damage which may result in the passive discharge. Thus, to protect our assets, we need to do preventive maintenance in order to anticipate along with the 24/7 monitoring on the grids, about where to change/repair the cables.

The cable industry is blessed to have a number of opportunities for the next twenty years. Some of the industry segments are already well-positioned. And the future is bright for the coming generations. Innovation and Imagination are essential in order to fulfill the common goal that I had mentioned at the start of my talk, which is – sustainability, because there is only one world.”

Mr. VK Bajaj, added, “It is true that the Indian cable industry is about USD 10 billion. In the next five years, it can go up to USD 20 billion. But we will have to compare it from the rest of the world. Therefore, it presents us with the opportunity for the Indian industry which I feel, has matured enough, with a lot of competitiveness, quality consciousness, and also the expertise and the technical skills available. Now, I think it is the right time for the industry to look beyond.

The opportunity has been presented by a number of factors including, negative sentiments against China as many nations around the world have been banning or putting some hurdles/barriers like tariff, duties, and so on. Thus, India seems to be very well-poised to take this advantage. Being quality-oriented is really important and this approach should be there in the whole hierarchy of an organisation, be it, the top management, or the workforce. The need for introspection and looking for ways to correct ourselves is really important.

In the last five years or so, we were doing about exports of about INR 100-150 crore. In the previous FY, we did about INR 762 crore of exports, and now, we are expecting to do exports of about INR 1500 crore. The amount we are going to attain for exports is also constrained by capacities. It is very essential that the quality culture should be ingrained in us. Also, I think that the industry is not paying that much heed to the aspect of packaging. Also, the people involved in the shipping also need to be educated properly that the packaging is important in the eyes of the customer.

On the raw materials side, we have to work closely with the raw material suppliers. And factors like Industry 4.0 and automation are playing a huge role in this regard. My suggestion to the key stakeholders will be to start looking global. It is true that the demand in the Indian market is growing, but many international markets are way ahead of us in terms of the demand in the industry. Thus, I am sure that we can grow in a much better way.

Considering the fire-related incidents in the country, the cross-linked zero halogen wires are the true solution to this menace. It is very necessary that the wire should be cross-linked and not thermoplastic. If it is so, the probability of fire will reduce drastically. Secondly, when we are discussing fire safety, it is important to consider that the conduit should also be a zero halogen material which ensures that there is no smoke. These are some of the considerations which are essential from the safety perspective. These are the basic parameters with regard to the quality of the wire/cable.

Thirdly, I came across a study report from an independent source which showed that the wires and cables which are being supplied in the domestic market have significantly compromised quality. This is where the management and the top stakeholders should take into account that these issues should be properly acknowledged and addressed.

The customers have become increasingly cognizant of environmental concerns and have been asking for sustainability reports from companies in the industry. This is another area where companies should make more efforts. We also publish our ESG report to inform our customers and people all around about our efforts in this regard. Moreover, we always strive to improve on this front, and reduce our carbon footprint. In the direction of Sustainability’, we also do a lot of projects regarding the reduction of carbon emissions, and being more sustainable. The customers are actually demanding these requirements from corporations, and this is all the more significant in the international market.

In 2009, we were an INR 100 crore-company, and we have reached the mark of INR 2100 crore in the previous FY. Now, we are hoping to attain the mark of more than INR 3000 crore in the current year, backed up by a lot of exports. We have a very vast product range, perhaps, one of the widest in the wire and cable industry. As an industry representative, I would say that we have a lot of opportunities available and we should work in this direction to tap onto the growth opportunities.”

Mr. Abhishek Gupta, added, “India is definitely on a big growth trajectory, and we all are experiencing something really phenomenal. And not just in India, the growth is phenomenal outside India as well. The Indian wire and cable industry is definitely very robust, resilient, as well as playing a very pivotal role. I am going to briefly talk about the industry – the challenges, and the opportunities. As per the recent reports, the electric wire and cable market is poised to grow by USD 1.65 billion during 2021-25, progressing at a CAGR of almost 4 percent.

The domestic wires and cables industry has registered robust growth over the last five years led by the government’s focus on providing power to all and gradual pickup from the housing market and the EV market. The market is expected to be driven by factors such as the growth in renewable power generation in India, the expansion and revamping of transmission and distribution infrastructure in India, and increasing investments in metro railways, data centers, and smart metering.

The government initiative like ‘Power for All’ has given a huge boost to the wire and cable sector. Moreover, the industry has grown sustainably over the past few years and the growth has continued in a significant way.

Significant investments in smart grid technology have resulted in an increasing need for grid interconnections. Smart grid technology is the future. Moreover, rising investments in underground cables in the SMART CITY and the growth of renewable energy are set to escalate the adoption of wires and cables. The smart cities will be like a model that is coming along, and when you would see a developing country and the best practices being adopted. In fact, India is telling the world that we are not far behind.

Wire and cable demand is directly dependent on the growth of the manufacturing industry as well as infrastructure in the power, telecommunications, residential, and commercial sectors. The industry is now looking forward to supplying cables for solar and wind power.

About the challenges, I would say that the major challenges are related to the quality of the wires and cables as well as the standards followed in the Indian wire and cable industry. Also, there is volatility in the prices of raw materials like copper, aluminium, PVC, and other components. There is a lack of awareness regarding eco-friendly wire and cable to reduce carbon footprint.

The future of the industry is green energy! The world is now looking at India to gear up as an alternative to China. Especially, the manufacturing industry of India and the growth of the exports, I am foreseeing a phenomenal growth in the demand. India can be the world’s factory. Now, the onus is on us – as a manufacturer, as an industry, and as an economy – to make the most of this window of opportunity. We are facing the fourth Industrial Revolution – “Industry 4.0”. Even if the growth takes up, the domestic wire and cable industry will not be able to cater to the demand that is there, until and unless they undertake significant expansions. What we have been doing over the years, it is a shining time for all of us in India.

Since the transportation sector is growing very fast, the railway industry is playing a vital role in this growth, and railways are the important sector that consumes wires and cables on a large scale. The Indian Railways has set a target of 100 percent electrification of its network by December 2023.

The future of data centres relies on proper cabling solutions. The increasing number of data centres and IT facilities for higher levels of availability, security, and affordable connectivity of IT infrastructure would increase the applications of wires and cables. In addition, 5G is projected to have a mass impact across many industries and change the lives of billions of both consumers and suppliers worldwide.

The demand for EV charging cables surged as governments around the world increasingly encouraged changing to low emission fuel vehicles. The rising demand for high-speed charging stations has compelled manufacturers of EV charging cables to develop advanced technology cables. The COVID period has taught us the importance of 5G technology, fibre-optics, etc. The EV market in India will be a USD 206 billion opportunity by 2030 if India maintains steady progress to meet its ambitious 2030 target. This would require a cumulative investment of over USD 180 billion in vehicle production and charging infrastructure. If we look at the EV market from any angle, any investment into this segment would be fruitful.”

The second panel discussion threw light on emerging trends, opportunities and challenges in the future. The eminent panel included Mr. Parth Aggarwal, Director, Paramount Communications Ltd., Mr. Sameer Agarwal, Managing Director, GK Winding Wires Ltd., Ms. Sonal Gariba, Executive Director, Ravin Group and Chairperson, IEEMA Cable Division, Mr. Varun Sawhney, Member (Core Management), Cords Cable Industries Ltd. and Mr. Sanjeev Atri, Head of Group-Plant Engineering, Tata Power Delhi Distribution Ltd. (TPDDL).

Digitalisation – A Megatrend

Mr. Parth Aggarwal from Paramount Communications said, “The wires and cables industry is an industry which has grown consistently in India over the last twenty five years or so. It has taken a major leap from being an unorganised sector to being a sector with a large number of organised companies which have performed consistently over the years. And that has been a very positive trend in the industry which we have seen.

The whole geopolitical scenario has had a very deep impact on the industry and the way our industry functions today. In the last two years, we have seen how our supply chain has been disrupted, from the availability of the raw material to the cost of the raw materials, and even the supply chain up to the customers. We have faced hurdles in all these arenas. When we talk about the raw materials today, the volatility in the prices of the metals that we have seen – has had a deep impact. The challenge comes in the consumer market, where we are working on relationships, and where we need to cushion our large channel partners against deep shocks. And that is where the large companies in India have shown, which have supported the channel partners in India really well, and have helped them survive this shock over the last few months.

The other challenge that our industry faces is from the government’s side, related to the payments. This definitely needs to be addressed from the topmost level, till all the PSUs, discoms, etc. There needs to be a solution for the industry to sustain and survive.

Today, we have been working upon quick turnaround time. It is essential that the wire and cable industry becomes efficient, and the efficiency can only come with quick turnaround time from the payments’ side. There have been some improvements, but I feel that there is a further scope of improvements in the electricity, and power discoms segment. And we are hopeful that with the huge pipeline of projects and the work and the investments that the government has been coming up with – they will take care of this as well. Now, if we talk about the trends, the key factor behind being a successful wire and cable company is being efficient. The industry has grown from the approach of profit margins to being scale-oriented. The better the scale, the more efficient you are! The aspects like client management, and customer relationships – are totally dependent upon our ability to service them.

Today, it is not only about the product that we are delivering but we have to give them good service, good turnaround time. And most of the companies are even giving them the execution services along with the products. Thus, the efficiency is a combined result of the supply chain, and a number of other factors. The supply chain should be clean. Then, the quality of the raw materials need to be sustained, and should be up-to-the-mark so as to be able to maintain the standing of the product in the market.

The COVID-19 pandemic has taught us that we cannot depend 100 percent on the manpower being physically present in the factory. We need to have developed, better ways, and better models of working.

We are very positive and aggressive on the growth of telecom in the country. We are expecting about 2 lakh km of overall optical fibre cable requirements to come through different routes, such as PSUs, PPP models, and many projects that are coming up in the next two-three years. And that is going to give the industry the much-needed relief. When it comes to the railways sector, the railways have been a consistent buyer, and a consistently good demand generator. However, the industry has faced its own challenges over the years.

And we are hopeful that with more stringent checks and requirements, and the emergence of more private players, the industry will perform even better. The Indian Railways has also been moving towards the PPP model, and with that, we are hoping that the standards of cables being supplied will also improve.

Regarding the opportunities, there is a USD 2 trillion infrastructure project in the pipeline that the government of India, under the leadership of Hon’ble PM Shri Narendra Modi, has been planning.

And the wire and cable industry stands to benefit the most in this infrastructure pipeline. This needs to come with proper systems, and the projects need to be well-financed as well as well-executed on a timely basis. If we are able to do this, we can easily become a USD 20 billion industry in the next few years. Another opportunity that has opened up for the Indian wire and cable industry at an overall level is on the exports’ side.

All over the world, be it Australia, Europe, North America, South America, and so on, a lot of companies have explored and set up strong markets. And companies of good positions themselves, in the tough times of the last three-four years, have been reaping benefits.

Regions like the Middle East, the European markets – both have booming demands, especially in terms of the telecom sector. We are seeing large requirements coming in, especially with the China plus one policy.

Another trend that is coming in is the GDP growth coming back into the picture. There have been a lot of industrial expansions, be it private or public, in industries such as steel, cement, automobile sector, EV, etc., we have been seeing huge expansions happening in the private sector. And this is a large opportunity for the wire and cable industry. That is an overall scope and we are hoping that with the USD 2 trillion investments proposal that has come out, we will be able to meet our requirements and we will be able to meet our growth targets.”

Talking about his company, Mr. Sameer Agarwal said, “We manufacture winding wires, which is the industry I represent. It is slightly different from the cable industry since it is basically used for winding applications, wherever you want the conversion of electricity from one form to another.

India has a per capita consumption of 600 gram of copper per person. And copper is considered to be ubiquitous, having presence in cables, appliances, automobiles, and so on. In China and Russia, the per capita consumption is around 5 kg. The developed part of the world including the USA and the European countries, we look at the per capita figures to the tune of 10 kg. And it is a known fact that we are one of the most populous countries in the world, which means that the growth opportunity is huge for us. We have to grow ten-fold and we have a huge population to back that kind of growth.

The Indian market for the winding wires is about 300,000 tonnes of copper, and for aluminium, it is about 40,000 tonnes. The Chinese market is almost 5-6 times our size, and it is still growing at a very stable pace. Thus, we are just one-fifth the size of China. To add to this, the trauma of the Industry today in India is that almost 60 percent of what we make is the lowest grade of the winding wires, which is the polyester grade, class-130. Whereas the rest of the world has only 8 percent of the winding wires consumed – which is of this lower grade. What this goes to show is that the Indian market is extremely price-sensitive. For us, cost mostly overrules quality, and we are not really looking at the upgradation of the product. But we are looking at just making sure that we stay afloat and stay cost-competitive. Our market is also very fragmented. Thus, fragmentation, also in itself implies even higher price-sensitivity in the market.

At times, manufacturers are cutting costs at the cost of the consumer. Just like the cable industry, the winding wire industry faces a similar situation of the prevalence of sub-standard or recycled copper. The substandard or recycled copper results in higher power consumption, and what the consumer doesn’t realise is that if he is paying a few hundred/thousand rupees lesser for a home appliance, he is actually ending up paying thousands, in terms of the higher power consumption. The government is cognitive of this, and is now introducing star-ratings in many products, including introducing star rating on ceiling fans, which is planned for this year.

Another very interesting thing that has happened in the winding wires industry is that since the copper prices have shot through the roof, there has actually been the shrinkage of quantum of the winding wires that was manufactured in the unroganised sector, because the unorganised sector does not have a banking line. And with the way the commodity prices have doubled, they cannot survive or service their customers without a banking line.

Another major reason that the sizable market is in the unorganised sector is the overall nature of the scrap supply chain. Thus, the scraps are available in the market, but scraps with proper billings are not available in the market. The winding wire association has already given this representation to the government. And if something like a reverse charge mechanism comes in terms of the sales of scrap sales/purchase, it will really help if more of the market shifts toward the organised sector. Our government has realised that economic growth is the key to a happy population. We all know that revolutions and uprisings have mostly happened around the globe in times of economic distress.

With the recent surge in the PLI scheme which is an opportunity that we ourselves are yet to understand, for the winding wires sector, and the cable industry alike, is phenomenal. The quantum of copper being imported into India by indirect means in the form of a complete motor, or a compressor, or a coil, is huge. And the PLI scheme will open doors for us to dream of achieving economies of scale, like countries like China, can dream of today. Because with the recent surge in Request for Quote (RFQ) that we have started receiving over the last few months, it seems to be like the next big opportunity that we should be having. The challenge in the situation for us is ensuring that the supply chain is equipped to handle the growth that we might see. I think that from 2023 onwards to the next decade will be a golden period in the field of manufacturing. Another very interesting fact is that the current per capita income in India is about USD 1900 and it is internationally well-researched that as soon as this number goes up to USD 3500, there is an inflection point. There is a sudden surge in terms of consumption and economic growth. Since, at the end of the day, it is the lower class or lower middle class section of the society whose salary actually affects the standard of their living. And if he has more disposable income, his consumerism and his ability to purchase will rise significantly. Thus, India projects that we are expected to reach this USD 3500 of per capita income by 2028.

According to me, there will have to be rapid digitisation which will not only enable us to manage better but it is also going to help us fill the vacuum of the right kind of talent. The fact is that the manufacturing industry still lacks in terms of attracting the right talents.

We, at GK Winding Wires, have tied up with a company which is enabling our digitalisation. We have been seeing amazing results out of this association. It is important for India to have a shift in thinking from thinking about costs to thinking about quality, from thinking about today to thinking on a long-term basis, from being ‘penny-wise and pound foolish’, from paper to digitisation – we need to have a paradigm shift from lagging behind to leading innovations in terms of manufacturing, rather than being followers and simply doing what everyone else in the world has been doing. I can really see this happening and I think the next decade in manufacturing is going to be something that we all need to watch out for, and actually be prepared for!”

Speaking on the occasion, Ms. Sonal Gariba said, “The industry has quite evolved over the years with a number of significant changes. Not only in terms of materials, but also the number of applications. We have been moving towards customisations in the cable industry, which now helps the buyers to choose tailor-made products that are apt for their applications. Be it, defence, railways, or any other industry, each of these is having their own specialised products. It not only enables saving money but enables the product with the experience. The shift has already happened.

The world is moving towards infrastructure growth in a manner where the fulcrum of everything is electricity. The terms “transmission” and “distribution” now implies a single term, which is “delivery”, that is, the power which is generated needs to be delivered. This is why transmission plus distribution equals delivery.

Most of the power is being generated through fossil fuels, coals, natural gas, etc, and to some extent, even nuclear energy. But now due to climate change, we are moving towards a more “sustainable” world. Hence, there has been a rise in solar, wind, biomass, and the latest in this trend is the growth in ‘green hydrogen’. However, from whatever source or form of electricity which is generated, it needs to be delivered to the end-user, for which the wires and cables are needed. Hence, it is very essential that we have innovations in the wire and cable industry.

With rapid urbanisation, the emphasis has shifted to a multi-pronged requirement. This would mean that there should be a paradigm shift in technology, which means great opportunities for the wire and cable industry.

With regard to the opportunities in the cable industry, there is a huge scope in the Electric Vehicles (EV) industry segment. So, the accessibility of the general public to the EV charging stations puts a lot of added responsibilities to the cables and wires wherein a need for upgradation in technology intertwined with safety and theft prevention. However, it is a very nascent industry which needs a lot of propagation and work that needs to happen in the domain. In the FIPC/hybrid cables, the use of telecommunications is in conjunction with HV/EHV links. Further with Artificial Intelligence and optics, we can now gauge the performance of the cables. For the High Voltage Direct Current (HVDC), there is a huge scope in the High Voltage (HV) and Extra High Voltage (EHV) segments with the push in infrastructure development. This will be seen in terms of – materials, cables, accessories, and also, installation practices.

We are moving from low voltages to higher voltages. And the transmission losses and distribution losses in the power sector will significantly come down if we shift towards HVDC cables. This is another area of opportunity for the industry.

Superconducting cables is another product in which a lot of work has been happening for quite some time, but it is not yet completely taken off-ground but we see this as one of the opportunities that lie ahead for the wire and cable industry in the future.

With regard to materials, there have been a lot of innovations in terms of nano technology, nano filled polymers, which holds a great scope in the future. Apart from this, there are sustainable, environmentally-friendly products that have already been developed that emit less smoke and emissions, and also improve visibility. In addition, there are smart electric highways wherein the smart roads combine physical infrastructures such as sensors and solar panels with software infrastructure like AI and big data. The smart road technology will enable in improving the visibility, generate electricity, communicate with autonomous and connected vehicles, and monitor the road conditions. Although it is a very expensive technology and it is still uncertain how useful it will be for our country – but we should still look towards this in the future. Speaking of expenses and technology, we should not forget a majorly important factor, i.e. safety.

On this note, it brings us to the challenges. The Indian market has always been a very price-sensitive market. Hence, the biggest challenge that lies ahead of us is in terms of meeting affordability. We, as an industry, must ensure that we do not compromise on the quality while trying to make the product affordable. Safety should be of prime importance. In this regard, we have made various representations to the government that we should move away from the price-alone concept to a holistic approach in the procurement policy. We are in a paradox here that on one hand, we talk about price and affordable products, then, on the other side, we also talk about packaging as being the first impact on the customers, which is the acceptable norm in the consumer market.

Presently, another major challenge is that we are not focused on R&D, and I would like to suggest that all companies must invest in R&D. This will not only foster innovations but will also help in being ahead of the technology curve.”

Mr. Varun Sawhney added, “With regard to the topic of this session, I have four trends in mind. Firstly, the growing trend of the Electric Vehicle (EV) segment. As per a research in January this year, we had about 9.1 lakh of EVs on the roads in India. As for the infrastructure of the EV charging stations, we have about 8000 public charging points, and about 7000 private charging points. This is a very small number, considering the size of the country. As per Niti Ayog, the aim regarding electric vehicles is about 10.2 crore by 2030. This will be a massive jump. For this, we require the infrastructure of charging stations, which is not there in the country. The charging infrastructure will be in three forms – firstly, it will be in the offices and homes, i.e. building complexes, secondly will be in the public charging stations, and third will be the mass-fleet charging. Thus, India is lagging behind drastically in the segment.

As per the estimates from the IEEMA, we require about 5-6 m of cable per charging point, and as per Niti Ayog, for those 10.2 crore vehicles by 2030, we require about 29 lakh public charging points. Now, about 70 percent of charging happens at homes/offices. Thus, just 29 lakh converts to 1.5 lakh km of cables in the next eight years for the EV charging infrastructure. I believe this is a huge opportunity for our industry! And globally, the EV charging infrastructure market should reach around USD 3173 million by 2028.

In my opinion, some of the challenges include – the requirement of land in cities to build these charging stations, and power load. Currently, the charging stations serve about 7.5 kW. We will need to attain 60-70 kW in the future. This is another challenge that we are going to face in the country. I believe that the wire and cable industry needs to gear up for these growth trends. The opportunity of 1.5 lakh km of cables is a huge requirement just for 30 percent of the market.

Second emerging trend which I would point out is the advent of digitalisation, and e-commerce in our country. We know that we are having massive investments in the segment in the last several years. In fact, the e-commerce space is also having new industrial players, comprising of players who serve the industry, including the wire and cable industry. In my understanding, in the wire and cable industry, the challenge is to convert the distribution channels for the e-commerce side. Thus, for the traditional or older players who have their presence in the B2C segment, it will probably be a little difficult to convert those channels towards the e-commerce side.

The third emerging trend is the entrance of lower quality products in our industry. I think IEEMA should play a very active role in this because there is a very serious challenge for our industry to become a quality-conscious market in the future. I would say that the fourth trend will be moving from C to C++, which is, from cables to cables++.

Many players are moving towards the EPC side, either towards the side of substations or automation. Some are also moving towards the FMEG side while others are moving towards the electrical bulk requirements. I believe that the quality players in the wire and cable industry now need to move ahead well, and to differentiate from the lower quality products, they need to invest in segments such as EPC, FMEG, etc. This would be the key for the future.”

Mr. Sanjeev Atri, said “Tata Power-DDL is a joint venture of the Tata Power Company Limited and the Government of Delhi. The consumer base is 1.8 billion, we are supplying power to 510 sq km, and the peak load is 2119 MW. We have brought down the AT&C losses from 53.1 percent to 7.8 percent. As for the network, there are around 1000 circuit km of HV network in the overhead lines. The power transformer capacity is 5000 MVA and 5400 MVA is the distribution transformer capacity. In addition, 1255 circuit km is of medium voltage (MV) overhead network, and 1000 circuit km of HT ABC. Whereas, the underground cable network takes up about 2900 circuit km of MV underground cables, and 2 circuit km is covered by conductors of medium voltage.

We have made a few initiatives directed at improving reliability, including, scheduled tree trimming, installation of silicon line spacers, installation of insulation sleeve on insulators, installation of capacitive animal repellant guards, and installation of sheared of PG connectors.

There are a few challenges in bare overhead power line networks, such as restriction of tree trimming>50 mm dia, no dedicated corridor of electric utility, declaring green zone in vicinity of o/h line, and plantation of high rise plant by horticulture authority near o/h lines. Additionally, there are issues like reliability hampers in rains, storms, earthquakes, etc., and safety clearances due to encroachments. We have been discussing this with the horticulture authorities to do plantations which have lower growth rate in terms of height near the power lines.

In order to improve the reliability of HT ABC, we finalise the installation process as per SANS 0198-14, and the specifications have also been revised as per SANS standard 1713. Now, we are very much satisfied with the reliability indices of the HT ABC cables. However, there are certain challenges in HT ABC cables like – non-availability of Indian Standard of Design of HT ABC, non-availability of Code of Practice for installation and maintenance of HT ABC, and there are span length restrictions.

We have installed a 3 km medium voltage covered conductor as per EN 50397 standard as a pilot project in FY 21-22. As the ongoing trend is to cover the bare conductors to covered conductors, we have been still observing this situation. As per standards, the covered conductors are not touch-proof and they must be treated as bare conductors with respect to electric shock. The covered conductors can protect tripping against accidental contact with other phased conductors and with grounded parts like trees. Also, planned maintenance required for tree trimming for preventing permanent touching of tree branches.

In the MV UG cables, heat dissipation is enhanced by 20 percent by designing co-extruded duct cables. The MTTR is reduced by 35 percent and the installation costs are reduced by 15 percent. In the Medium Voltage Underground cables, external damages are one of the major concerns. The challenges in the MV UG cable network is that there is no dedicated ROW for utilities while assets are being damaged by different utilities. It is a major concern for the industry. Moreover, there is a high road restoration cost involved.”

Day 1 concluded with an interesting panel discussion on ‘Promising Road Ahead for Telecom Sector and OFC Industry’, which had Mr. R. Sridharan, CEO, Birla Cable Ltd. and President, Vindhya Telelinks Ltd., Mr. Naivedya Agarwal, Co-Founder & CEO, Runaya Group, Mr. Vipul Nagpal, Founder & Managing Director, Orient Cables India Pvt. Ltd. and Mr. Sivakumar Nagarajan, Commercial Director, Corning India as the eminent speakers.

OFC – Backbone of Digital India

Mr. R. Sridharan said, “We all know that without telecommunications, the movement of data, and information is not possible. It has been proven in the last two years and due to the pandemic, we all faced a number of challenges and problems. And work-from-home culture has actually enhanced the growth of the Fibre-to-the-Home (FTTH) segment. This concept has grown in India like the western world. Thus, it is certainly true that the optical fibre industry has grown, despite the COVID-19 pandemic.

The Indian optical fibre and accessories market is valued at around USD 461 million in the year 2018. It is slated to reach almost USD 1066 million by 2026 with the clear CAGR of about 17.2 percent. Thus, there is a good growth rate which is being projected, and which is happening also despite the pandemic.

There are a lot of growth opportunities which I would like to touch upon regarding the role of the Indian market and what different countries around the globe have been achieving. Thus, we also need to reflect upon what kind of projects could enable us in achieving this kind of exponential growth. Firstly, the government-driven projects which are the backbone of the ‘Digital India’ initiative – which is the ‘BharatNet’ project. This is going to impact the growth of the entire industry, and the entire country.

What the Prime Minister of the country has envisioned is that in 1000 days, all the villages in every nook and corner of the country should be covered with optical fibre cables. Thus, it is a huge program which obviously has been impacted due to the pandemic resulting in the postponement and delay in the work related to the project. Now, those projects have been started again. This government-driven project is aimed at bridging the urban and rural digital divide which has been there, and this has been in the form of broadband connectivity to rural population in a big way. This is for the benefitting and upliftment of the rural populations. In the beginning, we were an agriculture-based economy. Hence, by increasing the broadband reach to every nook and corner of the country, the GDP will further grow. This will also result in the growth of entrepreneurship and business development. In this way, the economy will certainly be benefitted.

In this domain, the role of the government is to facilitate the rollout of the optical fibre network, and also promoting the concept of e-governance. Within the concept of e-governance, the first step is to ensure the availability of broadband connectivity with high-speed networks. This necessitates the need of proper optical fibre cable infrastructure, and for getting the proper connectivity. As I mentioned, our economy is primarily agriculture-based, thus the farmers should be empowered with the knowledge about various aspects related to farming like the monsoon patterns, and the soil quality, etc. For masses, factors like birth/death certifications are important. Then, healthcare – e-Medicine/e-Healthcare is one of the major concerns of e-governance in the country. During the pandemic, it has been proven that e-healthcare can be made possible as the people, who needed healthcare consultations, were speaking to the doctors through video conferences, telephone calls, etc. during the quarantine period. This was made possible through good broadband networks, 4G connectivity of which the backbone is optical fibre cables.

In addition, e-Education is also an important consideration in this respect. All the school/college children studied through digital mediums during the pandemic-led lockdown periods. In this way, the proper connectivity and proper FTTH networks are required. Although it was available however, there are still more miles to cover in our country. In Tier-2, Tier-3 cities or in villages, the network coverage is a huge issue. People are relying on mobile broadband and large-scale fibre connectivity is required.

Thus, this government program is aimed at enhancing the high-speed internet networks, the broadband connectivity, high bandwidth applications, and so on. For instance, the rural-based populations have also been looking to book their tickets to travel in a much easier and convenient way. And if they don’t have the network connectivity, they would be required to stand in queues at the ticket booking counters at railway stations, bus depots, etc. Thus, high-speed bandwidth networks are a big requirement. Optical Fibres are the enabler for these requirements! Optical fibre cables will be a game-changer in this respect. The government has been making huge efforts and strides in this direction and we should look forward to more such announcements of relevant schemes.

In the next five years, on a pan-India basis, the government is planning to lay more than 20 lakh route km of optical fibre cables under this ambitious BharatNet project. This will act as a backbone for the ‘Digital India’ program. In the next three-five years, the government has been planning to undertake this expansion in a very big way. Thus, it definitely augurs well for the optical fibre cable industry and the masses at large.

With regard to the private telecom operators, the existing service of the 4G technology played a huge role in the pandemic. Considering the private telecom operators like Jio, Bharti Airtel, etc., they can play an even bigger role in the fibre rollout. Now, since the beginning of this year, the fibre rollout program has again been picking up. The demand has been picking up. It is going to go up even further. Coming to the government-operated BSNL, the performance was not that good, thus, a lot of government-driven stimulus packages were given. Now, it is on a growth path with the stabilisation of the operations, and they are also coming up with their own projects under BharatNet as well as their own projects. The government has given a special spectrum for 4G and the government-owned enterprise is going to foray into 4G very shortly. Also, a homegrown 4G technology has been introduced for which pilot tests have already been undertaken.

Indian companies have been working in this domain so as to reduce their dependence on any other country with the goal of ‘Atmanirbhar Bharat’. All these programs, including the PLI scheme which has already been started, are going to benefit on a large-scale and a long-term basis. Thus, this year can be regarded as having brought stabilisation to both the public-owned and private-owned companies in the sector.

Also, the 5G services are going to come in a big way. The 5G is going to be a game-changer for a lot of technologies. There are some issues in 4G technologies like call drops, low speed, poor network connections, and low bandwidth. This is going to be addressed when we talk about the futuristic 5G technology. The impending introduction of 5G technology in mobile communication network will truly be possible with the enhanced deployment of optical fibre cables by four-five times as compared to the existing route length of optical fibre network for latest technologies like – machine-to-machine communication (M2M), artificial intelligence, IoT, autonomous cars, smart city applications, intelligent traffic management systems, data centres, Scada control systems in public utilities like – power generation, power transmission, and power distribution, water supplies, cross-country oil & gas pipeline system. All these mentioned high-speed, high-bandwidth transmission mediums in 5G technology are possible only by using optical fibre networks.

Last but not the least, the 5G, especially mobile communication can happen with fiberisation. Right now, the fibersiation of cell sites in towers is around 32 percent or so, which should be increased to 80-90 percent. This offers huge potential in the deployment of optical fibre cable in the cell sites. To summarise, the fibre km per capita consumption is very low in India as compared to the rest of the world, which is 0.09 while it is 1.35 in Japan, 1.34 in the USA, and 0.87 in China. Thus, it presents us with a huge scope of further development and growth opportunities.

With this, I would like to conclude my session and as I had already discussed that the pre-COVID consumption in India was less than 18 million fibre km. We are targeting to reach 30 million fibre km this year and 40 million fibre km in the next year. A lot of expansion is happening in all the countries around the world. Now, the consumption of OFC is expected to increase multi-fold due to the impending network expansion in both government-driven projects and private telecom operators. This is further expected to improve by various network rollout programmes of internet service providers (ISPs), power utilities, and oil & gas sector.”

Speaking on the occasion, Mr. Naivedya Agarwal said, “I would begin with an overview of Runaya Group which is a startup in the industry. We are one of the fastest-growing manufacturing startups in India, with a very strong focus on sustainability and providing technology-driven solutions in India with the global best practices.

Specifically, we have the current capacity of 1.5 million fibre km which we will expand to attain 2 million fibre km by the end of this year, and 4 million fibre km by the end of the next year. This is of course driven by the expansion we have been seeing in the OFC manufacturing industry. The growth in OFC demand directly translates into the growth of the FRP demand. The rapidly growing OFC market is expected to reach 650 million fibre km by 2025. The three main areas of the OFC consumption include the long-haul cables for inter-city development, the submarine cables for inter-continental or trans-national data transfer, and access cables for inter-cities which play a role in data centre connectivity, and smart city projects being driven by the Government of India. Of course, the biggest demand push is going to come from last-mile connectivity, and this is where we see the exponential growth of FRP demand with surge in FTTH penetration. This is also being driven from more data consumption and the rise in OTT platforms. Moreover, there has also been an emergence of smart buildings along with IoT, A.I., and so on.

Now, coming to the FRP demand, the FRP demand is directly proportional to the demand for OFC. The average global ratio is about 48 fibres to 1 FRP rod, with Europe and the USA being taking an average of 60+ fibres to 1 rod, and the developing countries taking 25 fibres to 1 FRP rod. This also demonstrates that India is still far behind in terms of its fibre development, and FRP manufacturing requirement, and that ratio is likely to increase in India as well. As most countries including India look for more localisation of the supply chain to reduce the dependence on China, we see that the prime focus of our manufacturing will also be India-based.

Now, we have also been seeing more product-diversifications with more value-added products for various applications. For instance, the flat FRP rods are used for cables with high fibre count. As we go into more last-mile connectivity, ARP rods are increasingly used. For underground cables, water-swellable FRP rods are used, and medium adhesion FRP rods are used for the easier installation of FTTx connections. Then, there are also steel-embedded FRP rods and oval rods.

At Runaya, we have also been closely working with all of our customers to develop this entire range of value-added products to ensure that we can be a one-stop destination for solutions for our customers, as well as work directly with them to increase their efficiency. We have installed a small solar rooftop plant and we are committed to be completely powered by solar energy by 2024. We are minimising our resin and scrap emissions. We have also installed AI-backed vision cameras to monitor the quality of our solutions and reduce the wastage of any materials.”

Talking about his company, Mr. Vipul Nagpal added, “Orient Cables started its journey in 2002. We were one of the earliest companies in India which started experimenting with the manufacturing of LAN cables. Over the years, we have kept our focus very specific into the IT and the Telecom sector. I am happy to share that about 15 percent of our sales have been from exports in 2021-22. Now, we are very bullish regarding growth in the next two years with very significant expansion plans.

Cables are like silent performers for the networks. While they are always taken for granted and rarely seen or noticed, they play a major role. In fact, cables can be considered as an equivalent of the nervous system in human bodies, which keeps the devices running, and is precisely engineered at every inch.

When we talk about the global trends, it is very much aligned with the trends that we have been seeing in India. In 2021, the optical fibre cable market was sized about 9.20 billion, and it is projected to reach USD 23.40 billion at a CAGR of 17.7 percent. All in all, it is a great time for the OFC Industry and the growth has been driven by BharatNet project, 5G deployments, and Smart City projects.

Considering the LAN cables which is one of our largest verticals, we see the market growing but not as aggressively as fibre cables. The research report says that in the period of 2022-2031, the global LAN cable market is expected to grow at a CAGR of 5.02 percent. The threats or challenges to the LAN cable market are – the growth of the wireless segment, the optical fibre cables are getting cheaper, and the advancement of the 5G technology. Moreover, there are also opportunities for the LAN cable market segment, including POE smart devices, IP CCTV cameras, more data centres, and automation systems. Thus, the potential is very high and this opens up a lot of possibilities. The IP CCTV cameras operate on the LAN cable systems. Also, there will be an emergence of a lot more data centres with the demand for cloud computing is expected to go up exponentially. Besides, the automation systems are also operated using LAN cables.